Waaree Energies Share Price Target Tomorrow From 2025 To 2030- Market Overview, Current Chart

Waaree Energies is one of India’s leading solar energy companies, known for its trusted quality and clean energy solutions. The company is working to make solar power more affordable and available across India and globally. People feel happy and satisfied with Waaree’s solar panels and services because they are reliable, efficient, and environmentally friendly. Waaree Energies Share Price on NSE as of 16 June 2025 is 2,824.20 INR. This article will provide more details on Waaree Energies Share Price Target 2025, 2026 to 2030.

Waaree Energies Ltd: Company Info

- Headquarters: India

- Number of employees: 1,752 (2024)

- Subsidiaries: Waaree Renewable Technologies Ltd, Indosolar.

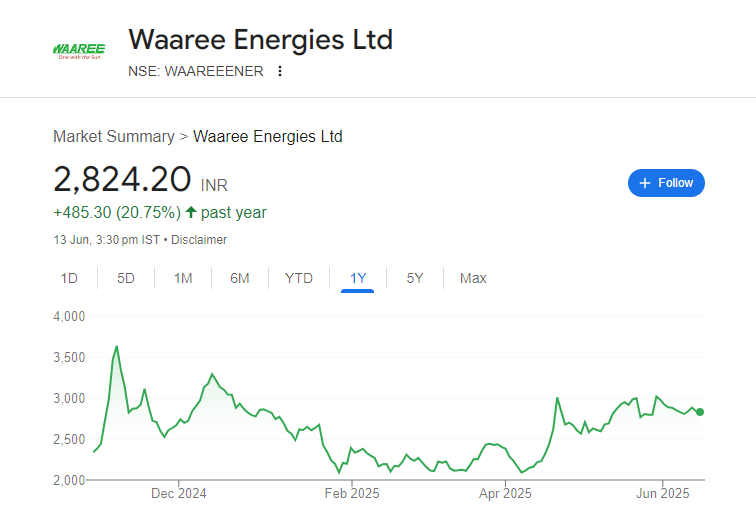

Waaree Energies Share Price Chart

Waaree Energies Share: Market Overview

- Open: 2,742.30

- High: 2,839.90

- Low: 2,742.30

- Mkt cap: 81.16KCr

- P/E ratio: 41.56

- Div yield: N/A

- 52-wk high: 3,743.00

- 52-wk low: 1,863.00

Waaree Energies Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Waaree Energies for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹3750

- 2026 – ₹4270

- 2027 – ₹4810

- 2028 – ₹5350

- 2029 – ₹5990

- 2030 – ₹6540

Waaree Energies Share Price Target 2025

Waaree Energies share price target 2025 Expected target could be between ₹3700 to ₹3750. Here are 7 key factors that could influence the growth of Waaree Energies share price by 2025:

1. Robust Capacity Expansion & Vertical Integration

Waaree is rapidly scaling its manufacturing base—targeting ~19 GW of module capacity, along with cell and wafer facilities, both in India and the US. This vertical integration boosts margins and revenue potential.

2. Strong Q3 Financial Performance

The company reported a 260 % YoY increase in PAT and a ~116 % rise in revenue in Q3 FY25, with EBITDA margins improving to ~21 %—indicating healthy execution and profit growth that could support a higher share price .

3. Growing Order Book & US Market Presence

Waaree holds a massive ~20–26 GW order book, with exports (especially to the US) accounting for ~20–60 % of revenue. The recent 599 MW US order win highlights increasing global demand .

4. Expansion into Adjacent Energy Segments

The company is branching out into electrolyzers, battery energy storage (BESS), inverters, transformers, and green hydrogen—positioning itself as a diversified clean-energy.

5. Supportive Government Policies & PLI Scheme

Waaree benefits from India’s renewable energy push and Production-Linked Incentives (PLI), which support domestic capacity growth and reduce dependence on.

6. Favorable Industry Tailwinds

The global solar sector is riding strong momentum, fueled by cost reductions, demand from data centers and EV charging, and a pivot away from China—benefiting Waaree’s expansion .

7. Elevated Valuation & Analyst Targets

While brokers like Kotak and Nuvama have set price targets around ₹2,550–₹2,805—anchored to projected capacity growth and earnings—current valuations may already reflect much of the upside, leaving limited room for surprise gains.

Waaree Energies Share Price Target 2030

Waaree Energies share price target 2030 Expected target could be between ₹6500 to ₹6540. Here are 7 key risks and challenges that could affect Waaree Energies’ share price by 2030:

1. Heavy Dependence on U.S. Market

Nearly all of Waaree’s exports go to the U.S. (~98.7% of export revenue in FY23), exposing it to demand fluctuations, policy changes, or tariffs in that single market.

2. Raw Material & Supply Chain Vulnerability

About 70–90% of Waaree’s input materials are sourced from China, making it vulnerable to geopolitical risks, export restrictions, and price volatility.

3. Solar Module Price Volatility

Sharp declines in global module prices (e.g., a 21% drop in early FY24) can erode profit margins, especially if Waaree is locked into long-term contracts at higher costs.

4. Fierce Competition

Domestic and global solar manufacturers (like Trina, Jinko, etc.) drive price competition. Waaree must continually innovate to maintain margins.

5. Customer Concentration Risk

Top 5 clients generate ~40–57% of revenue, and exports were ~65–73% of total revenue in early FY24. Losing any major customer could significantly impact earnings.

6. Policy Dependence & Regulatory Shifts

Waaree relies on renewable energy policies (PLI, subsidies, tariffs). Any policy reversal or reduction may hurt its competitiveness and profitability.

7. Corporate Governance & Execution Risks

Concerns include high insider/promoter influence, contingent liabilities, ESOP dilution, and possible execution delays in international capacity expansion.

Shareholding Pattern For Waaree Energies Share

| Held By | May 2025 |

| Promoters | 64.3% |

| Flls | 0.7% |

| Dlls | 2.46% |

| Public | 32.54% |

Waaree Energies Financials

| (INR) | 2025 | Y/Y change |

| Revenue | 144.45B | 26.73% |

| Operating expense | 16.05B | 48.08% |

| Net income | 18.67B | 50.94% |

| Net profit margin | — | — |

| Earnings per share | 67.85 | — |

| EBITDA | 27.22B | 74.01% |

| Effective tax rate | 24.82% | — |

Read Also:- Hyundai Motor Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview