Tata Power Share Price Target Tomorrow From 2025 To 2030- Market Overview, Financials

Tata Power is one of India’s most trusted and oldest power companies, serving millions of homes and businesses with reliable electricity. It is a part of the respected Tata Group and is known for its strong focus on clean and green energy. The company is working hard to produce more electricity from the sun and wind, helping India move toward a cleaner future. Tata Power also manages power supply in big cities like Mumbai and Delhi. Tata Power Share Price on NSE as of 11 June 2025 is 413.20 INR. This article will provide more details on Tata Power Share Price Target 2025, 2026 to 2030.

Tata Power Ltd: Company Info

- CEO: Praveer Sinha (1 May 2018–)

- Founded: 1911

- Founder: Dorabji Tata

- Headquarters: Mumbai

- Number of employees: 22,372 (2024)

- Parent organization: Tata Group

- Revenue: 63,272.32 crores INR (US$7.9 billion, 2024).

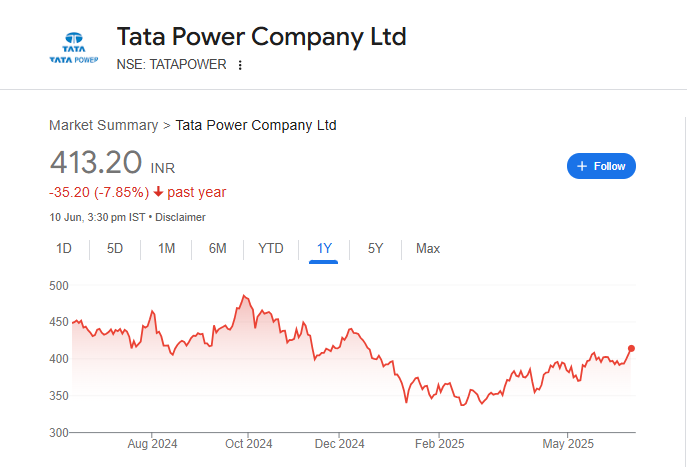

Tata Power Share Price Chart

Tata Power Share: Market Overview

- Open: 409.00

- High: 416.00

- Low: 406.20

- Mkt cap: 1.32LCr

- P/E ratio: 33.30

- Div yield: 0.54%

- 52-wk high: 494.85

- 52-wk low: 326.35

Tata Power Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Tata Power for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹500

- 2026 – ₹540

- 2027 – ₹580

- 2028 – ₹620

- 2029 – ₹660

- 2030 – ₹700

Tata Power Share Price Target 2025

Tata Power share price target 2025 Expected target could be between ₹490 to ₹500. Here are 7 key factors affecting the growth of Tata Power’s share price toward 2025:

-

Strong Renewables Order Book

Tata Power is adding significant solar, wind, and hybrid energy capacity. Its renewables business saw profits grow 62% YoY in Q4 FY25, with new manufacturing capacity on the rise. -

Robust Financial Performance

In FY25, consolidated PAT reached ₹5,197 cr (up 26%), and EBITDA rose 14% to ₹14,468 cr. This financial strength reassures investors. -

Integrated Value Chain & Solar Manufacturing

The company manufactures solar cells and modules (4.3 GW capacity) and adds generation projects—allowing better cost control and profits. -

Diversified Business Model

Apart from renewables, Tata Power also operates thermal, T&D, and city distribution (like Odisha and Mumbai), reducing business risk. -

Supportive Renewable Policies & Investments

The government’s clean energy push aligns with Tata Power’s ₹9 bn investment plan to expand renewable capacity to 20 GW by 2030. -

Transmission & Storage Expansion

New ventures in transmission (like the TPREL $5.6 bn Andhra project) and pumped storage signal diversification and higher earnings potential. -

Analyst & Market Optimism

Major brokerages like ICICI, BOB, JM Financial, and Goldman Sachs rate Tata Power “Buy,” targeting ₹470–₹600 by 2025, underscoring broad confidence.

Tata Power Share Price Target 2030

Tata Power share price target 2030 Expected target could be between ₹690 to ₹700. Here are 7 key risks and challenges that could impact Tata Power’s share price by 2030:

-

Dependence on Regulatory Approvals

Power projects—especially in renewables and distribution—require multiple clearances. Delays in land acquisition or environmental approvals can slow down execution. -

Fluctuating Coal and Energy Prices

While Tata Power is growing in renewables, it still has significant thermal operations. Global coal price volatility can affect fuel costs and impact margins. -

High Capital Expenditure Needs

The company plans to invest heavily in renewable projects, storage, and grid upgrades. Any funding issues or delays in returns on these investments could stress finances. -

Competition in Renewable Energy

Many companies (Adani Green, NTPC Green, JSW Energy) are entering the green energy space. Intense competition may reduce profitability or delay market share growth. -

Technological Disruption

Rapid changes in energy technology (e.g., battery storage, hydrogen, AI-driven grids) may require continuous upgrades. Failing to adopt new tech could hurt Tata Power’s edge. -

Climate and Environmental Risks

Climate events like floods, cyclones, or droughts may impact both renewable and conventional infrastructure, especially in vulnerable regions. -

Policy and Tariff Uncertainty

Sudden changes in power tariffs, renewable incentives, or taxation policies by the government could affect revenue models and investor confidence.

Shareholding Pattern For Tata Power Share

| Held By | Mar 2025 |

| Promoters | 46.86% |

| Flls | 9.39% |

| Dlls | 16.2% |

| Public | 27.56% |

Tata Power Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 654.78B | 6.56% |

| Operating expense | 154.33B | 32.54% |

| Net income | 39.71B | 7.43% |

| Net profit margin | 6.06 | 0.66% |

| Earnings per share | 9.79 | -10.36% |

| EBITDA | 139.30B | 31.40% |

| Effective tax rate | 25.94% | — |

Read Also:- Varun Beverages Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview