Sunlite Recycling Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview

Sunlite Recycling Industries Ltd. is a growing company in India known for recycling copper scrap into high-quality wires and rods. With a focus on eco-friendly practices and sustainable production, Sunlite helps reduce waste and support the environment. Many customers and investors appreciate the company for its consistent quality, fast service, and strong financial growth. Sunlite Recycling Share Price on NSE as of 21 June 2025 is 166.00 INR. This article will provide more details on Sunlite Recycling Share Price Target 2025, 2026 to 2030.

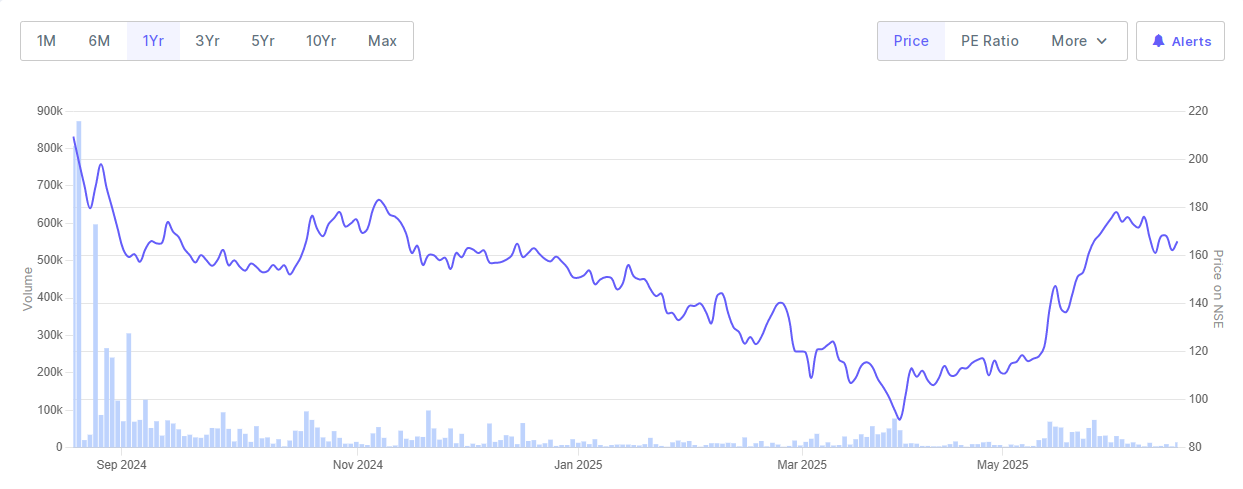

Sunlite Recycling Share Price Chart

Sunlite Recycling Share: Market Overview

- Market Cap: ₹ 180 Cr.

- Current Price: ₹ 166

- High / Low: ₹ 210 / 91.0

- Stock P/E: 12.6

- Book Value: ₹ 55.2

- Dividend Yield: 0.00 %

- ROCE: 35.9 %

- ROE: 35.6 %

- Face Value: ₹ 10.0

Sunlite Recycling Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Sunlite Recycling for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹210

- 2026 – ₹240

- 2027 – ₹280

- 2028 – ₹320

- 2029 – ₹360

- 2030 – ₹400

Sunlite Recycling Share Price Target 2025

Sunlite Recycling share price target 2025 Expected target could be between ₹200 to ₹210. Here are 7 key factors that could drive Sunlite Recycling Industries Ltd.’s share price growth by 2025:

-

Strong Financial Performance & Profitability

The company’s revenues rose steadily from ₹93.2 crore in FY22 to ₹116.7 crore in FY24, with PAT doubling to ₹8.9 crore in FY24—showing a healthy profit trend. -

High Return Ratios Indicate Efficient Capital Use

Sunlite Recycling boasts an impressive ROE of ~44% and ROCE around 31%, which suggests strong efficiency in generating returns on capital. -

Rapid Asset Growth & Capacity Addition

Total assets grew from ₹48 crore (FY22) to ₹63 crore (FY24), reflecting ongoing investments in machinery and infrastructure to support future demand. -

Undervalued Compared to Peers

Despite strong metrics, the stock trades at a low P/E (~10×) and P/B (~7×), with IPO pricing at just 5–6× relative to peers at ~16×—indicating potential for valuation upside. -

IPO Success & Market Confidence

The IPO was oversubscribed nearly 282× and opened 90% above issue price, demonstrating strong investor confidence and market buzz. -

Growing Copper Recycling Demand

As a specialized recycler of copper scrap into rods and wires, Sunlite stands to benefit from rising global copper demand and sustainability trends. -

Reducing Debt Improves Financial Strength

The company has reduced its debt-to-equity ratio significantly—from ~12.8× in FY23 to ~1.7× in FY24—strengthening its balance sheet and reducing financial risk.

Sunlite Recycling Share Price Target 2030

Sunlite Recycling share price target 2030 Expected target could be between ₹390 to ₹400. Here are 7 key risks and challenges that could impact Sunlite Recycling Industries Ltd. and its share price outlook by 2030:

-

Raw Material Price & Supply Volatility

The company depends on copper scrap, with 96% of production costs tied to it, and has no long-term supply agreements. Sudden increases in scrap prices or shortages can hit margins hard. -

Customer & Supplier Concentration

A few key suppliers and customers dominate the business—over 50% of purchases are from the top 10 suppliers, and the top 10 customers account for ~40% of revenue. Losing any could significantly impact earnings. -

Geographic Concentration Risk

Most operations and sales are centered in Gujarat. A regional slowdown, regulatory changes, or logistical issues could threaten business continuity and revenue. -

High Debt Levels

Despite reducing debt recently, the debt-to-equity ratio remains elevated (1.7×), which could add financial pressure if earnings dip or further investments are needed. -

Low Margins and Commodity Business Nature

Operating in a high-volume, low-margin industry means even small cost increases or pricing pressures can hurt profitability. -

Substitution Threat from Alternative Materials

Copper wires face competition from cheaper, lighter aluminum alternatives. This substitution risk could reduce demand and margin for Sunlite’s core products. -

Evolving Environmental & Regulatory Norms

As recycling regulations tighten and environmental compliance standards increase, the company may need to spend more on cleaner technologies and regulations, which could raise costs.

Shareholding Pattern For Sunlite Recycling Share

| Held By | May 2025 |

| Promoters | 73.77% |

| Flls | 0.32% |

| Dlls | 0% |

| Public | 25.91% |

Read Also:- Jupiter Wagons Share Price Target Tomorrow From 2025 To 2030- Market Overview, Current Chart