SRF Share Price Target Tomorrow From 2025 To 2030- Market Overview, Financials

SRF Limited is a leading Indian company known for its strong presence in chemicals, packaging films, and technical textiles. It has earned a good name for its quality products, innovation, and consistent performance. From making refrigerant gases to specialty chemicals used in industries worldwide, SRF plays a key role in many sectors. The company is trusted by its customers for its commitment, timely delivery, and high standards. SRF Share Price on NSE as of 09 June 2025 is 3,119.00 INR. This article will provide more details on SRF Share Price Target 2025, 2026 to 2030.

SRF Ltd: Company Info

- Headquarters: Gurugram

- Number of employees: 7,372 (2024)

- Parent organization: Kama Holdings Ltd.

- Revenue: 14,870 crores INR (FY23, US$1.9 billion)

- Subsidiaries: SRF Altech Limited, SRF Global BV.

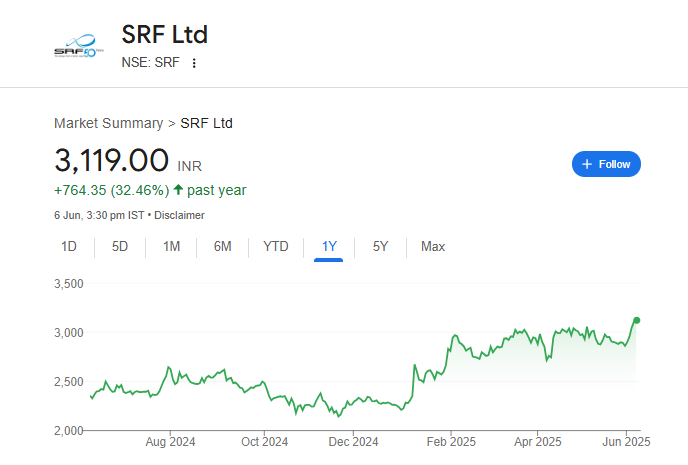

SRF Share Price Chart

SRF Share: Market Overview

- Open: 3,119.80

- High: 3,139.00

- Low: 3,084.80

- Mkt cap: 92.45KCr

- P/E ratio: 73.91

- Div yield: N/A

- 52-wk high: 3,139.00

- 52-wk low: 2,126.85

SRF Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of SRF for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹3140

- 2026 – ₹3625

- 2027 – ₹4230

- 2028 – ₹4764

- 2029 – ₹5255

- 2030 – ₹5774

SRF Share Price Target 2025

SRF share price target 2025 Expected target could be between ₹3130 to ₹3140. Here are 7 key risks and challenges for SRF Limited (SRF) Share Price Target 2030:

-

Weak Demand in Core Chemicals

The specialty chemicals segment—home to agrochemicals, refrigerants, and conditioning agents—has seen uncertain demand and inventory destocking, affecting volumes and margins. -

Pressure from Low-Cost Imports

Cheaper chemical imports (especially from China and Thailand), particularly in packaging films and refrigerant segments, have put margin pressure on SRF. -

Currency and Interest Rate Risks

A strong US dollar increases costs for inputs sourced internationally, while rising global interest rates could raise borrowing expenses. -

Geo-political & Trade Vulnerabilities

Export-reliant segments like specialty chemicals and packaging films remain exposed to geopolitical tensions, trade barriers, and regulatory changes. -

High Valuation Expectations

SRF currently trades at elevated valuations (P/E ratios ~60–70x FY25–26 earnings), leaving little margin for error if growth slows. -

Execution Risk on Capex Plans

With large-scale capex underway in specialty chemicals, packaging films, and PTFE plants, any delays or cost overruns can hurt returns and miss growth forecasts. -

Technological & Competitive Changes

Rapid innovation and competition in specialty segments like fluoropolymers, refrigerants, and technical textiles require SRF to continuously invest in R&D and upgrade technology.

SRF Share Price Target 2030

SRF share price target 2030 Expected target could be between ₹5760 to ₹5774. Here are 7 key risks and challenges that may impact SRF Limited’s share price target by 2030:

-

Dependence on Global Demand

SRF exports a large part of its specialty chemicals and packaging films. If global demand slows down due to economic issues, it can directly impact the company’s revenue. -

Raw Material Price Fluctuations

The prices of key raw materials, especially chemicals and polymers, can change often. Sudden price increases can reduce the company’s profit margins. -

Tough Competition in Packaging and Chemicals

SRF faces competition from both Indian and international players. Strong competition can lead to pricing pressure and affect growth in market share. -

Delay in Large Capital Projects

SRF has big expansion plans. If these new plants or projects face delays or go over budget, it could affect future performance and returns. -

Regulatory and Environmental Risks

The chemical industry must follow strict rules related to pollution and safety. Any new laws or environmental issues may lead to higher costs or restrictions. -

Currency Exchange Rate Risk

As SRF earns a lot from exports, changes in foreign exchange rates (like a weak rupee or strong dollar) can affect its earnings. -

High Market Expectations

Since SRF’s stock is already valued highly, any underperformance or missed targets can disappoint investors and lead to a sharp fall in share price.

Shareholding Pattern For SRF Share

| Held By | Mar 2025 |

| Promoters | 50.26% |

| Flls | 18.27% |

| Dlls | 18.43% |

| Public | 13.04% |

SRF Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 146.93B | 11.83% |

| Operating expense | 35.76B | -14.56% |

| Net income | 12.51B | -6.36% |

| Net profit margin | 8.51 | -16.32% |

| Earnings per share | 42.20 | -6.35% |

| EBITDA | 28.38B | 11.19% |

| Effective tax rate | 26.58% | — |

Read Also:- Atul Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials