SBI Card Share Price Target Tomorrow From 2025 To 2030- Market Overview, Current Chart

SBI Card is one of India’s leading credit card companies and a trusted name among millions of users. It is backed by the State Bank of India, which adds extra confidence and reliability for customers. Known for its wide range of credit card options, SBI Card offers great rewards, cashback, travel benefits, and easy EMI facilities. SBI Card Share Price on NSE as of 18 June 2025 is 989.75 INR. This article will provide more details on SBI Card Share Price Target 2025, 2026 to 2030.

SBI Cards and Payment Services Ltd: Company Info

- CEO: Abhijit Chakravorty (12 Aug 2023–)

- Founded: October 1998

- Headquarters: Gurugram

- Number of employees: 3,829 (2024)

- Parent organization: State Bank of India

- Revenue: 17,483 crores INR (FY24, US$2.2 billion).

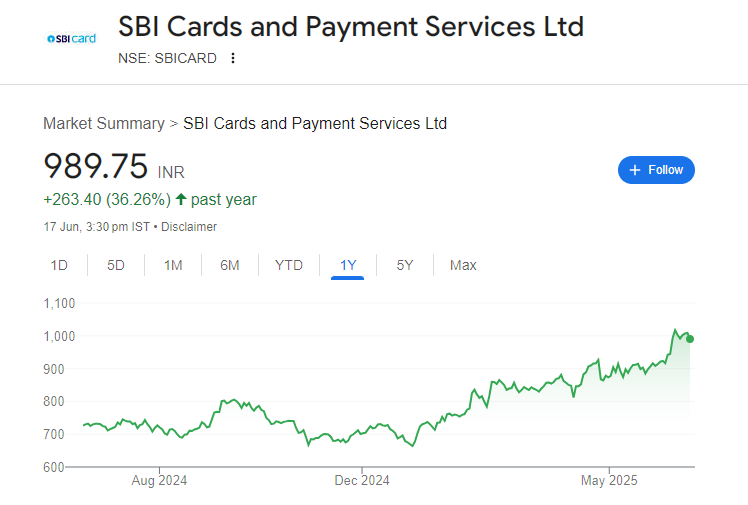

SBI Card Share Price Chart

SBI Card Share: Market Overview

- Open: 1,008.70

- High: 1,009.75

- Low: 989.50

- Mkt cap: 94.27KCr

- P/E ratio: 49.14

- Div yield: 0.25%

- 52-wk high: 1,027.25

- 52-wk low: 659.80

SBI Card Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of SBI Card for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹1050

- 2026 – ₹1300

- 2027 – ₹1550

- 2028 – ₹1800

- 2029 – ₹2050

- 2030 – ₹2300

SBI Card Share Price Target 2025

SBI Card share price target 2025 Expected target could be between ₹1030 to ₹1050. Here are 7 key factors that could drive the growth of SBI Card’s share price by 2025:

-

Robust consumer spending & retail loans

Retail credit demand remains strong, with cardholder spending up ~11% YOY, which boosted interest income nearly 28% in Q4 2024. -

Asset-quality stabilization

Brokerages like Nomura, Nuvama, and Goldman Sachs are bullish, noting that bad-loan provisions seem to have peaked—optimism driven by improved credit trends. -

Aggressive marketing and digitization

SBI Card is expanding into Tier‑2 and Tier‑3 cities, enhancing its digital platforms, and launching co-branded and personalized offers—boosting new user acquisition. -

Rise in digital payments ecosystem

Growth in UPI, RuPay, and EMI-on-UPI integration is expanding SBI Card’s potential use cases, making credit cards more accessible and attractive. -

Cost-to-income and operational efficiency

SBI Card has improved its cost-to-income ratio by aggressively managing opex, which is enhancing profitability—driving upgrades in FY25–26 estimates. -

Supportive regulatory & macro trends

RBI’s gradual easing of capital requirements on personal and card loans and easing credit-cycle concerns are expected to support growth. -

Positive brokerage sentiment & targets

Multiple brokerages (Nomura, Nuvama, Kotak, ICICI, Goldman) have retained buy ratings with target prices between ₹825–950, reflecting confidence in continued performance.

SBI Card Share Price Target 2030

SBI Card share price target 2030 Expected target could be between ₹2280 to ₹2300. Here are 7 key risks and challenges that could affect SBI Card’s share price outlook by 2030:

-

Rising Credit Costs & Asset Quality Pressure

Continued elevation in delinquencies and impairments could squeeze margins. Q3 2025 saw a 30% drop in profit due to an 89% spike in write-offs, with gross NPAs at ~3.24%. -

Intense Market Competition

HDFC, ICICI, Axis, fintechs, and BNPL firms are aggressively targeting card users. SBI Card’s heavy retail-tiers 2/3 focus limits growth in the more profitable premium segment. -

Regulatory & Capital Constraints

RBI’s tighter risk weights and stricter limits on credit growth and fees raise compliance costs and may curtail flexibility in underwriting and revenue models . -

Technology & Cybersecurity Threats

Rising cybercrime in India makes data breaches a serious risk. SBI Card previously experienced a major compromise (~1.5 million records in 2021). -

Customer Experience & Operational Hiccups

Reddit users report slow service, glitches in KYC processing, mis-sold products, and poor communication—damaging brand loyalty and attracting regulatory scrutiny:“I had to practically fight … to get him to process my cancellation request.”

“Five separate verification calls … It was exhausting, borderline traumatic.” -

Dependence on SBI Brand & Partnership Risk

Heavy reliance on SBI for brand and distribution support introduces vulnerability—any issues with SBI’s reputation could have a knock-on effect. -

Economic Slowdowns & Consumer Spending Divergence

A macro downturn or rising interest rates may lower consumer card usage, leading to reduced fee and interest income. The shift towards UPI/BNPL also threatens to erode core revenues.

Shareholding Pattern For SBI Card Share

| Held By | May 2025 |

| Promoters | 68.6% |

| Flls | 9.88% |

| Dlls | 17.22% |

| Public | 4.3% |

SBI Card Financials

| (INR) | 2025 | Y/Y change |

| Revenue | 100.22B | -9.65% |

| Operating expense | 1.71B | -94.35% |

| Net income | 19.16B | -20.41% |

| Net profit margin | 19.12 | -11.93% |

| Earnings per share | 20.14 | -20.61% |

| EBITDA | — | — |

| Effective tax rate | 25.74% | — |

Read Also:- Sarveshwar Foods Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview