Patel Engineering Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview

Patel Engineering is a trusted Indian company known for building big infrastructure projects like dams, tunnels, roads, and power plants. With many years of experience, the company has played an important role in shaping India’s infrastructure. People appreciate Patel Engineering for its quality work, timely project delivery, and strong technical skills. The company focuses on both public and private sector projects and continues to grow steadily. Patel Engineering Share Price on NSE as of 09 June 2025 is 42.80 INR. This article will provide more details on Patel Engineering Share Price Target 2025, 2026 to 2030.

Patel Engineering Ltd: Company Info

- Headquarters: India

- Number of employees: 4,580 (2024)

- Subsidiaries: Patel Energy Limited.

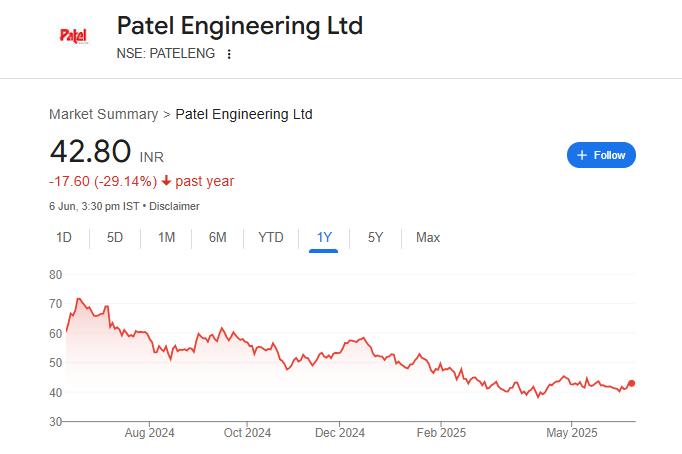

Patel Engineering Share Price Chart

Patel Engineering Share: Market Overview

- Open: 43.08

- High: 43.48

- Low: 42.50

- Mkt cap: 3.44KCr

- P/E ratio: 14.86

- Div yield: N/A

- 52-wk high: 74.40

- 52-wk low: 35.68

Patel Engineering Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Patel Engineering for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹80

- 2026 – ₹100

- 2027 – ₹120

- 2028 – ₹140

- 2029 – ₹160

- 2030 – ₹180

Patel Engineering Share Price Target 2025

Patel Engineering share price target 2025 Expected target could be between ₹70 to ₹80. Here are 7 key factors affecting the growth of Patel Engineering Ltd. (PATELENG):

-

Strong Order Book

Patel Engineering has a healthy order book worth ₹17,396 crore as of December 2024, providing nearly four years of revenue visibility. This robust pipeline supports sustained growth . -

Focus on High-Margin Projects

The company specializes in high-margin sectors like hydro power, tunneling, and irrigation, which constitute approximately 93% of its order book. This strategic focus enhances profitability . -

Debt Reduction Initiatives

Patel Engineering has reduced its debt from ₹5,400 crore in FY17 to ₹1,422 crore in Q3FY25, improving its debt-to-equity ratio to 0.38x. This reduction lowers interest expenses and strengthens financial stability . -

Positive Operating Cash Flow

The company has reported positive operating cash flow over the past four years, with working capital days standing at 100, primarily driven by unresolved arbitration claims and land holdings . -

Government Infrastructure Initiatives

Patel Engineering is well-positioned to benefit from the Indian government’s focus on infrastructure development, including projects under the Pradhan Mantri Krishi Sinchayee Yojana and various hydropower initiatives . -

Strategic Diversification

The company is expanding its presence in urban infrastructure and transport sectors, diversifying its project portfolio and reducing reliance on traditional segments . -

Analyst Optimism

Brokerages like ICICI Direct and Ventura Securities have set target prices of ₹80 and ₹63, respectively, citing strong execution capabilities, reduced debt, and increased infrastructure spending as key growth drivers .

Patel Engineering Share Price Target 2030

Patel Engineering share price target 2030 Expected target could be between ₹170 to ₹180. Here are 7 key risks and challenges that could impact Patel Engineering’s share price target by 2030:

-

Execution Delays in Projects

Infrastructure projects like dams, tunnels, and hydroelectric plants often face delays due to land issues, legal clearances, or local protests. Such delays can impact revenue and increase costs. -

High Dependence on Government Orders

A large part of Patel Engineering’s business comes from government contracts. Any slowdown in public infrastructure spending or change in political priorities may affect the company’s order flow. -

Debt and Working Capital Pressure

Though the company has reduced debt, infrastructure projects require heavy working capital. If future debt levels rise again or receivables get stuck, it could create financial stress. -

Cost Overruns and Budget Challenges

Construction costs may increase due to rising prices of raw materials, labor shortages, or unexpected challenges at project sites, which may hurt profit margins. -

Regulatory and Environmental Risks

Projects like hydro power and tunneling are subject to strict environmental regulations. Any new rules or public opposition can delay or stop major projects. -

Limited International Presence

Patel Engineering mainly operates within India. Limited global diversification means its growth is tightly linked to domestic economic and policy conditions. -

Tough Competition

The company faces competition from large players like L&T, NCC, and others in the EPC and infrastructure space. Competitive bidding may lead to lower profit margins in future projects.

Shareholding Pattern For Patel Engineering Share

| Held By | Mar 2025 |

| Promoters | 36.11% |

| Flls | 5.01% |

| Dlls | 4.69% |

| Public | 54.19% |

Patel Engineering Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 50.93B | 12.09% |

| Operating expense | 7.65B | 16.06% |

| Net income | 2.48B | -14.60% |

| Net profit margin | 4.87 | -23.79% |

| Earnings per share | 4.16 | — |

| EBITDA | 7.26B | 5.94% |

| Effective tax rate | 26.53% | — |

Read Also:- Mahanagar Gas Share Price Target Tomorrow From 2025 To 2030- Market Overview, Current Chart