MRPL Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials

Mangalore Refinery and Petrochemicals Limited (MRPL) is a well-known name in India’s oil and energy sector. It is a part of the ONGC Group and operates a large and advanced oil refinery in Karnataka. MRPL is known for producing high-quality petroleum products like diesel, petrol, LPG, and petrochemicals that power homes, vehicles, and industries. Many users trust MRPL for its reliable operations, strong performance, and commitment to energy needs. MRPL Share Price on NSE as of 19 June 2025 is 135.82 INR. This article will provide more details on MRPL Share Price Target 2025, 2026 to 2030.

Mangalore Refinery and Petrochmcls Ltd: Company Info

- Founded: 7 March 1988

- Headquarters: Mangaluru

- Number of employees: 2,548 (2024)

- Parent organization: Oil and Natural Gas Corporation

- Revenue: 86,161 crores INR (US$11 billion, 2022)

- Subsidiaries: Shell MRPL Aviation Fuels and Services Limited.

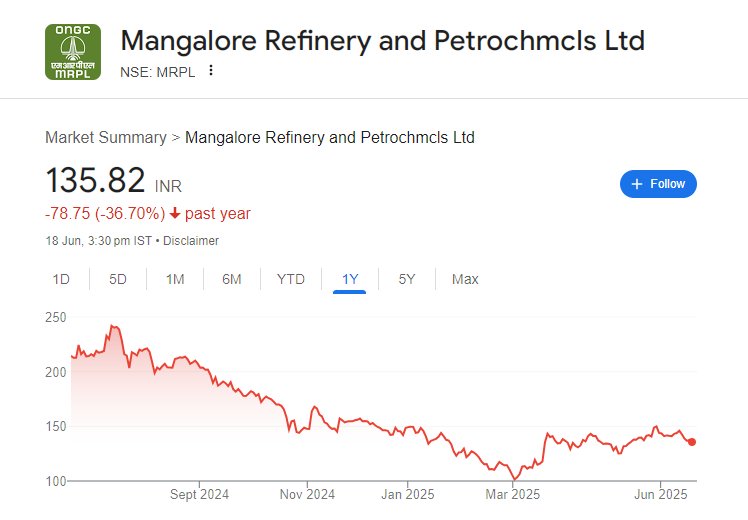

MRPL Share Price Chart

MRPL Share: Market Overview

- Open: 137.25

- High: 137.69

- Low: 134.64

- Mkt cap: 23.76KCr

- P/E ratio: 424.44

- Div yield: 2.21%

- 52-wk high: 253.56

- 52-wk low: 98.92

MRPL Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of MRPL for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹260

- 2026 – ₹280

- 2027 – ₹310

- 2028 – ₹340

- 2029 – ₹370

- 2030 – ₹400

MRPL Share Price Target 2025

MRPL share price target 2025 Expected target could be between ₹₹250 to ₹260. Here are 7 key factors likely to influence MRPL’s (Mangalore Refinery & Petrochemicals Ltd) share price growth by 2025:

-

Profit Margin Recovery & Strong Q4 Performance

MRPL saw a sharp rise in profitability in March 2025, with Profit Before Tax up ~92% and Profit After Tax up ~79% compared to its previous quarterly average. This earnings momentum could support a higher share price. -

High Refining Capacity & Product Mix Advantage

With a processing capacity of 15 million tonnes per annum, dual hydrocrackers, and two CCR units, MRPL produces premium diesel and high-octane petrol—helping it maintain strong margins. -

Valuation at Attractive Levels

Despite a high P/E (~430×), analysts from MarketsMojo consider the stock undervalued and attractive—suggesting potential for re-rating if earnings stay robust. -

Industry-Wide Tailwinds for Oil & Gas

As a subsidiary of ONGC, MRPL benefits from India’s push in the oil & gas sector underpinned by economic growth and fuel demand—supporting healthy utilization of its facilities. -

Analyst Price Targets Provide Support

Wall Street analysts forecast a 1-year average price target around ₹127, with a range of ₹106–143. While slightly below the current price, this indicates a floor and suggests upside if fundamentals improve. -

Efficient Operations and Technology Edge

MRPL consistently runs at ~97–98% capacity and uses advanced hydrocracking and catalytic reforming technologies—boosting output, yield, and operational efficiency. -

Macro and Pricing Cycles in the Refining Space

MRPL’s profitability is tied to global oil prices and refining spreads. Stabilizing crude and product margins will be key to sustaining earnings and driving the share price upward.

MRPL Share Price Target 2030

MRPL share price target 2030 Expected target could be between ₹390 to ₹400. Here are 7 key risks and challenges that could affect MRPL’s (Mangalore Refinery & Petrochemicals Ltd) share price outlook by 2030:

-

Volatility in Crude Oil Prices

MRPL’s business depends heavily on global crude oil prices. Sudden increases or decreases in crude prices can impact refining margins and overall profitability. -

Geopolitical Uncertainty

Being in the oil and gas sector, MRPL is exposed to global geopolitical tensions (like conflicts in the Middle East or sanctions on oil-producing countries), which can disrupt crude supply and affect pricing. -

Environmental Regulations and ESG Compliance

Stricter government rules on emissions, pollution control, and carbon neutrality could lead to higher compliance costs. Delays in adopting green technology may hurt long-term sustainability. -

Dependence on Import of Crude Oil

India imports most of its crude oil. Any issues with import logistics, rising import bills, or currency depreciation (weaker rupee) could impact MRPL’s input costs and margins. -

Competition from Private Refineries

MRPL faces strong competition from larger, private refiners like Reliance and Nayara Energy, which have more advanced infrastructure and export capabilities, potentially affecting market share. -

Technology Shifts and Renewable Energy Growth

The global shift toward electric vehicles and renewable energy could reduce long-term demand for traditional fuels like diesel and petrol, putting pressure on MRPL’s core business model. -

Execution and Expansion Risk

Any delay or failure in capacity upgrades, technology improvements, or diversification efforts could limit MRPL’s ability to stay competitive, especially in a fast-changing energy landscape.

Shareholding Pattern For MRPL Share

| Held By | May 2025 |

| Promoters | 88.58% |

| Flls | 1.3% |

| Dlls | 1.33% |

| Public | 8.79% |

MRPL Financials

| (INR) | 2025 | Y/Y change |

| Revenue | 946.82B | 4.73% |

| Operating expense | 45.13B | 35.02% |

| Net income | 562.10M | -98.44% |

| Net profit margin | 0.06 | -98.49% |

| Earnings per share | 0.29 | -98.59% |

| EBITDA | 22.93B | -71.13% |

| Effective tax rate | 52.72% | — |

Read Also:- E2E Networks Share Price Target Tomorrow From 2025 To 2030- Market Overview, Current Chart