Jaiprakash Power Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials

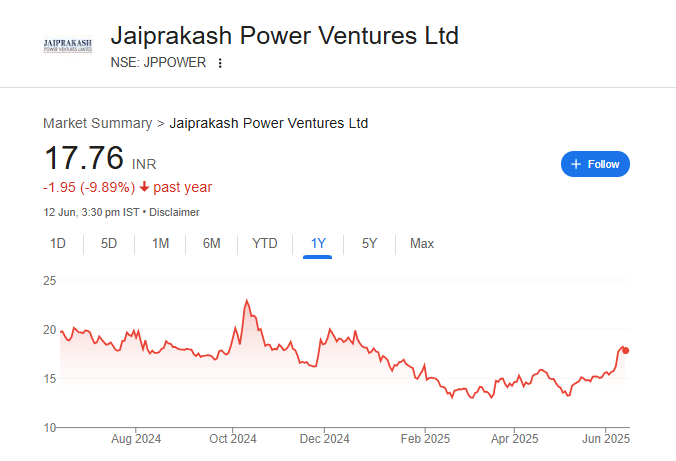

Jaiprakash Power Ventures, also known as JP Power, is an Indian power company involved in generating electricity through thermal and hydro sources. It is gradually becoming a trusted name in the power sector, especially with its efforts to focus more on renewable energy. Many users appreciate the company’s growing clean energy projects and its aim to support India’s energy needs. Jaiprakash Power Share Price on NSE as of 13 June 2025 is 17.76 INR. This article will provide more details on Jaiprakash Power Share Price Target 2025, 2026 to 2030.

Jaiprakash Power Ltd: Company Info

- Founded: 1994

- Headquarters: India

- Number of employees: 2,102 (2024)

- Parent organization: Jaypee Group

- Subsidiaries: Bina Power Supply Company Limited.

Jaiprakash Power Share Price Chart

Jaiprakash Power Share: Market Overview

- Open: 18.29

- High: 18.67

- Low: 17.62

- Mkt cap: 12.13KCr

- P/E ratio: 19.96

- Div yield: N/A

- 52-wk high: 23.77

- 52-wk low: 12.36

Jaiprakash Power Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Jaiprakash Power for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹25

- 2026 – ₹30

- 2027 – ₹35

- 2028 – ₹40

- 2029 – ₹45

- 2030 – ₹50

Jaiprakash Power Share Price Target 2025

Jaiprakash Power share price target 2025 Expected target could be between ₹23 to ₹25. Here are 7 key factors affecting the growth of Jaiprakash Power Ventures (JP Power) and its potential share price trajectory by 2025:

-

Renewable Capacity Expansion

JP Power aims to increase its renewable power capacity from ~2,900 MW to over 4,000 MW by 2025, aligning with India’s clean energy goals—a vital growth lever. -

Investments in Solar & Wind Projects

The company is launching advanced solar projects (including a 1,000 MW photovoltaic plant) and investing in wind energy, fueling diversified clean energy revenues. -

Strategic Acquisitions

Recent asset acquisitions worth ~₹1,500 crore bolster JP Power’s renewable portfolio and accelerate capacity build-out. -

Strong Financial Health

With healthy solvency (current ratio ~1.32–1.8) and moderate debt-to-equity (~1.4), the company has a solid base to support capital-intensive growth. -

Improving Profitability & Cash Flows

Rising EBITDA (~₹1,200 cr FY22–23), interest coverage (~3.8×), and better operating cash flows signal favorable momentum in earnings and liquidity. -

Government & Regulatory Tailwinds

India’s renewable energy policies, subsidies, and target of 500 GW by 2030 support JP Power’s expansion strategy. -

Strategic Partnerships & Technology

Collaborations with global players like Siemens Gamesa and investments in clean-tech infrastructure boost efficiency, output, and competitiveness.

Jaiprakash Power Share Price Target 2030

Jaiprakash Power share price target 2030 Expected target could be between ₹47 to ₹50.

Here are 7 key risks and challenges that could impact Jaiprakash Power Ventures (JP Power) and its share price outlook by 2030, explained in easy language:

-

Heavy Debt Overhang & Resolution Uncertainty

JP Power carries a massive debt load—over ₹58,000 cr as of March 2023—which strains its financial flexibility . Additionally, uncertainty over lender strategy could delay resolution efforts and impact the parent group’s recovery . -

Execution Delays & Cost Overruns in Projects

Large infrastructure and renewable projects in India often face delays related to land, permits, and technical issues. These setbacks may raise costs and reduce returns . -

Fuel Price Volatility & Thermal Segment Exposure

Rising coal and fuel prices directly hurt thermal power profits. As an integrated power player, JP Power is vulnerable when input costs surge. -

Renewables Sector Risks

The green energy space is competitive, and India’s renewable expansion has seen cancellations, tender undersubscriptions, and unsigned PPAs (~40 GW pipeline stalled), which threaten growth forecasts. -

Promoter Pledge & Governance Concerns

The promoters hold ~24% shares, of which a high ~79% is pledged. This raises risk of forced selling if margin calls arise. -

Financial Ratios & Asset Quality Pressure

The net debt/EBITDA ratio was ~4.5× in FY2023—high leverage indicating tight coverage . Weak profitability and flat or low ROE (~0.5%) also limit ability to rebuild equity. -

Regulatory & Market Volatility

India’s power market is subject to policy shifts in tariffs, environmental rules, grid curtailments, and stress in distribution utilities—all of which can impact JP Power’s revenues and cash flow.

Shareholding Pattern For Jaiprakash Power Share

| Held By | Mar 2025 |

| Promoters | 24% |

| Flls | 6.31% |

| Dlls | 17.52% |

| Public | 52.16% |

Jaiprakash Power Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 57.08B | -15.60% |

| Operating expense | 7.93B | 5.45% |

| Net income | 8.14B | -20.39% |

| Net profit margin | 14.25 | -5.69% |

| Earnings per share | — | — |

| EBITDA | 21.34B | -4.50% |

| Effective tax rate | 33.07% | — |

Read Also:- Ola Electric Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview