IREDA Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials

IREDA, short for Indian Renewable Energy Development Agency, is a government-owned company that supports clean energy in India. It helps finance solar, wind, hydro, and other green energy projects. Many people trust IREDA because of its strong backing by the government and its focus on a greener future. Users and investors are happy with its simple and transparent working style. IREDA Share Price on NSE as of 12 June 2025 is 182.50 INR. This article will provide more details on IREDA Share Price Target 2025, 2026 to 2030.

Indian Renewable Energy Dev Agency Ltd: Company Info

- Founded: 1987

- Headquarters: India

- Number of employees: 173 (2024)

- Revenue: 3,482 crores INR (US$440 million, FY23)

- Subsidiary: M/s IREDA Global Green Energy Finance IFSC Limited.

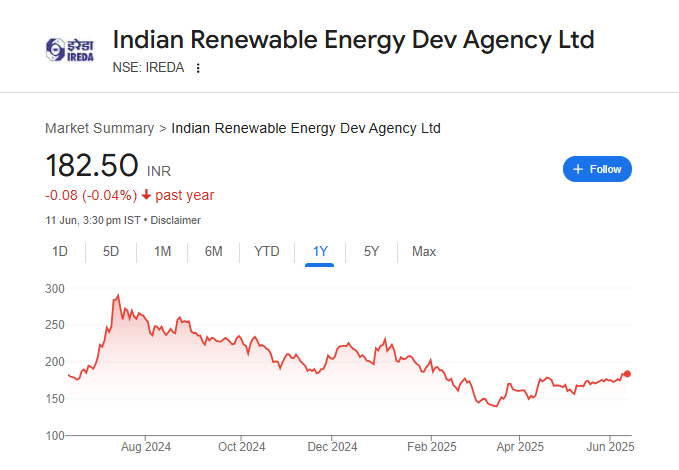

IREDA Share Price Chart

IREDA Share: Market Overview

- Open: 181.90

- High: 184.48

- Low: 179.50

- Mkt cap: 49.00KCr

- P/E ratio: 28.88

- Div yield: N/A

- 52-wk high: 310.00

- 52-wk low: 137.01

IREDA Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of IREDA for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹320

- 2026 – ₹340

- 2027 – ₹360

- 2028 – ₹380

- 2029 – ₹400

- 2030 – ₹420

IREDA Share Price Target 2025

IREDA share price target 2025 Expected target could be between ₹310 to ₹320. Here are 7 key factors affecting the growth of IREDA (Indian Renewable Energy Development Agency) share price target for 2025:

-

Government Support and Policies

Strong backing from the Indian government through renewable energy policies, subsidies, and budget allocations can positively impact IREDA’s business growth and investor confidence. -

Rising Demand for Clean Energy

India’s increasing need for clean and sustainable energy sources is boosting investments in solar, wind, and other renewables—areas where IREDA plays a major financing role. -

Loan Disbursement and Recovery

Growth in the loan book and timely recovery from borrowers will improve IREDA’s profitability, financial health, and share price. -

Expansion into New Renewable Segments

IREDA’s expansion into new areas like green hydrogen, bioenergy, and energy storage could open up fresh business opportunities and attract investor interest. -

Low-Cost Funding Access

The ability to raise funds at low interest rates from domestic or international markets helps IREDA offer competitive financing to renewable energy projects, supporting business growth. -

Strong Financial Performance

Healthy net profits, improved asset quality, and lower NPAs (non-performing assets) contribute to a positive market outlook and influence share price movement. -

Public Awareness and ESG Focus

Increased awareness about environmental issues and a global push toward ESG (Environmental, Social, and Governance) investing make IREDA an attractive option for socially responsible investors.

IREDA Share Price Target 2030

IREDA share price target 2030 Expected target could be between ₹410 to ₹420. Here are 7 key risks and challenges that could impact the IREDA (Indian Renewable Energy Development Agency) share price target by 2030:

-

Credit Risk and Rising NPAs

As a lender, IREDA faces the risk of defaults from renewable energy companies, especially smaller or financially weak borrowers. A rise in non-performing assets (NPAs) could affect profitability and investor trust. -

Interest Rate Fluctuations

An increase in interest rates may raise IREDA’s borrowing costs, reducing its ability to offer low-cost loans to renewable projects, which can impact its competitiveness and margins. -

Policy and Regulatory Uncertainty

Any unfavorable changes in renewable energy policies, tax benefits, or lending regulations can slow down project approvals and loan disbursements. -

Delayed Renewable Projects

Renewable energy projects often face delays due to land acquisition issues, environmental clearances, or supply chain disruptions, which can affect IREDA’s loan recovery and growth plans. -

Overdependence on Government Support

As a government-owned company, IREDA heavily relies on policy backing and budgetary support. Any change in government focus or funding could affect its future operations. -

Technological and Market Disruptions

Rapid technological changes or cheaper alternatives in the energy sector could shift the market dynamics, affecting IREDA’s existing project pipeline and loan portfolio. -

Climate and Environmental Risks

While IREDA supports green energy, extreme weather events or climate-related disruptions can damage infrastructure or delay operations, posing risks to financed projects and returns.

Shareholding Pattern For IREDA Share

| Held By | Mar 2025 |

| Promoters | 75% |

| Flls | 1.75% |

| Dlls | 0.51% |

| Public | 22.74% |

IREDA Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 23.35B | 29.39% |

| Operating expense | 1.93B | 50.09% |

| Net income | 16.98B | 35.62% |

| Net profit margin | 72.73 | 4.83% |

| Earnings per share | 6.32 | 22.48% |

| EBITDA | — | — |

| Effective tax rate | 19.26% | — |

Read Also:- ITC Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials