International Conveyors Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials

International Conveyors Ltd. is a trusted name in India’s industrial equipment sector, especially known for manufacturing high-quality conveyor belts. These belts are widely used in mining, cement, and other heavy industries. The company has earned a strong reputation for delivering durable products, on-time service, and consistent performance. International Conveyors Share Price on NSE as of 21 June 2025 is 91.30 INR. This article will provide more details on International Conveyors Share Price Target 2025, 2026 to 2030.

International Conveyors Ltd: Company Info

- Founded: 1973

- Headquarters: India

- Number of employees: 94 (2024)

- Subsidiaries: International Belting Limited.

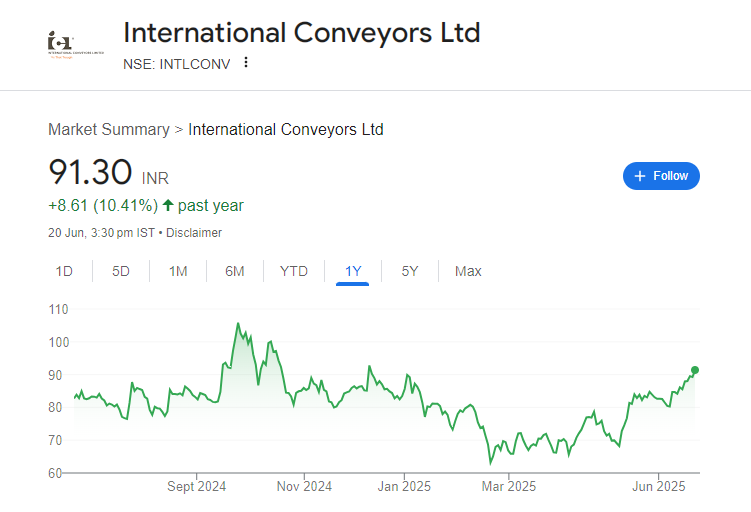

International Conveyors Share Price Chart

International Conveyors Share: Market Overview

- Open: 89.25

- High: 93.00

- Low: 88.26

- Mkt cap: 578.65Cr

- P/E ratio: 6.31

- Div yield: N/A

- 52-wk high: 110.70

- 52-wk low: 61.20

International Conveyors Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of International Conveyors for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹115

- 2026 – ₹127

- 2027 – ₹140

- 2028 – ₹152

- 2029 – ₹165

- 2030 – ₹178

International Conveyors Share Price Target 2025

International Conveyors share price target 2025 Expected target could be between ₹112 to ₹115. Here are 7 key factors likely to influence International Conveyors Ltd.’s share price by 2025:

-

Strong Revenue & Profit Growth

Q4 FY25 saw net profit more than double, rising 114% to ₹13.03 crore, while quarterly sales surged over 110%—indicating strong business momentum. -

Excellent Profit Margins & Return Ratios

The company enjoys impressive net profit margins (~23%) and ROE/ROCE (~38–44%), reflecting efficient operations and effective capital use. -

Undervaluation vs Cash Flow

Despite solid free cash flow, International Conveyors is trading at a low P/E (~5.5×) and EV/EBITDA (~4×), suggesting potential upside from private market re-rating. -

Stable, Low-Leverage Financials

The balance sheet is very healthy with minimal debt and consistent positive cash flow and dividends—adding to financial stability. -

Growing Core Product Demand

While best known for conveyor belts, the company’s expansion into wind energy (4.65 MW capacity) points to gradual diversification. -

High Dividend Track Record

A steady dividend payout (~26%) over the last decade has built investor trust and signals long-term profitability. -

Potential Downside from Cash vs. Earnings Gap

A high accrual ratio (~0.23) indicates that some reported profits are not yet converted to cash—investors should watch if this persists.

International Conveyors Share Price Target 2030

International Conveyors share price target 2030 Expected target could be between ₹175 to ₹178. Here are 7 key risks and challenges that could impact International Conveyors Ltd. and its share price performance by 2030,:

-

Heavy Dependence on Conveyor Belt Segment

Most of the company’s revenue comes from a single product line—conveyor belts used mainly in mining and bulk material handling. This lack of diversification can limit growth and increase business risk if demand slows. -

Limited Market Reach and Size

Compared to larger players in the conveyor and industrial equipment space, International Conveyors has a relatively small global footprint. This may limit its ability to compete in bigger contracts or expand into new geographies. -

Cyclical Demand from Mining & Infrastructure

The company’s business is closely linked to sectors like mining, cement, and power. Any slowdown in these sectors due to policy changes, global economic downturns, or environmental restrictions could affect order flow. -

Raw Material Price Volatility

The manufacturing of conveyor belts involves rubber, synthetic materials, and chemicals. A sudden rise in raw material prices can eat into profit margins if not passed on to customers. -

Working Capital & Cash Flow Risks

Though the company shows strong profits, a high accrual ratio hints that some earnings are not yet received as cash. If this gap continues, it could cause liquidity pressure in the long run. -

Technological Obsolescence & Competition

The conveyor belt industry is evolving with smart automation and sensor-based systems. If International Conveyors fails to keep up with new technologies, it could lose out to more innovative competitors. -

Environmental & Regulatory Pressures

As ESG norms and environmental laws tighten globally, the company may have to invest more in clean production and compliance. This could raise costs and impact future earnings if not managed properly.

Shareholding Pattern For International Conveyors Share

| Held By | May 2025 |

| Promoters | 69.14% |

| Flls | 0.02% |

| Dlls | 0% |

| Public | 30.85% |

International Conveyors Financials

| (INR) | 2025 | Y/Y change |

| Revenue | 546.00M | 110.29% |

| Operating expense | 129.10M | 24.56% |

| Net income | 130.30M | 114.56% |

| Net profit margin | 23.86 | 2.01% |

| Earnings per share | — | — |

| EBITDA | 105.35M | 407.39% |

| Effective tax rate | -34.05% | — |

Read Also:- BEL Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview