Cressanda Solutions Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview

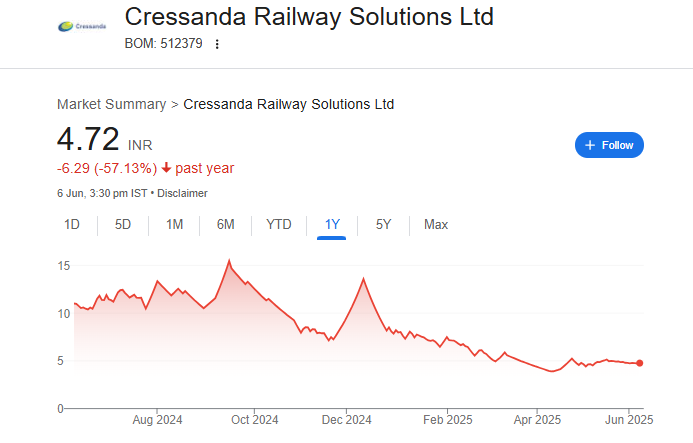

Cressanda Solutions is an emerging Indian company that works in the fields of digital technology, smart infrastructure, and railway services. The company is gaining attention for its efforts to improve passenger experience in Indian Railways through services like digital displays, smart ticketing, and in-train entertainment. Cressanda Solutions Share Price on BOM as of 09 June 2025 is 4.72 INR. This article will provide more details on Cressanda Solutions Share Price Target 2025, 2026 to 2030.

Cressanda Solutions Ltd: Company Info

- Headquarters: India

- Number of employees: 18 (2024)

- Subsidiaries: Lucida Technologies Private Limited, Mastermind Advertising Private Limited, Cressanda Solutions, Inc.

Cressanda Solutions Share Price Chart

Cressanda Solutions Share: Market Overview

- Open: 4.72

- High: 4.79

- Low: 4.69

- Mkt cap: 199.72Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 5.23

- 52-wk low: 3.89

Cressanda Solutions Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Cressanda Solutions for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹5.25

- 2026 – ₹9.20

- 2027 – ₹14,30

- 2028 – ₹18.60

- 2029 – ₹22.90

- 2030 – ₹26.20

Cressanda Solutions Share Price Target 2025

Cressanda Solutions share price target 2025 Expected target could be between ₹5.20 to ₹5.25. Here are 7 key factors affecting the growth of Cressanda Solutions (Cressanda Railway Solutions) share price target for 2025:

-

Rise of Smart Railways

Indian Railways is adopting technologies like IoT, sensors, and AI to enhance operations and safety. With its focus on rail-tech, Cressanda is well-positioned to benefit from this digital transformation. -

Expansion in Digital Media & Concierge Services

Projects like in-train advertising, ticketing systems, Wi-Fi, digital kiosks, and concierge services are growing. Cressanda’s domain expertise and recent empanelment with Eastern Railways and CBC support this trend. -

Strategic Acquisitions Boosting Capabilities

The acquisition of Lucida Technologies (digital and analytics) and stake in Mastermind Advertising sharpen Cressanda’s tech and market reach.. -

Strong Financial Growth Metrics

In Q2 FY24, revenue rose 38% QoQ to ₹19.5 cr and PAT jumped to ₹5.1 cr—boosting investor confidence in the company’s financial momentum. -

Diversification Through Infra & Renewable Segments

Beyond railways, Cressanda is building into healthcare, education, mobility, and renewable energy via its ‘Infra nXT’ and ‘Technology nXT’ initiatives. -

Government Collaborations & Empanelments

Empanelment by Central Bureau of Communication enables more government advertising opportunities, expanding its service portfolio. -

Focus on Innovation & Tech Advancement

Ongoing emphasis on predictive maintenance, analytics platforms, and process automation positions Cressanda ahead in the tech value chain.

Cressanda Solutions Share Price Target 2030

Cressanda Solutions share price target 2030 Expected target could be between ₹26.10 to ₹26.20. Here are 7 key risks and challenges for Cressanda Solutions Share Price Target 2030:

-

High Dependence on Railway Projects

A major part of Cressanda’s business comes from Indian Railways. Any delay or cancellation of railway contracts can affect growth and revenues. -

Execution Risk in Large Contracts

Managing and delivering large-scale digital and tech infrastructure projects on time is complex. Any delay or underperformance can hurt reputation and profits. -

Regulatory and Policy Uncertainty

Changes in government policies, bidding rules, or public sector priorities can directly impact Cressanda’s future projects and pipeline. -

Intense Industry Competition

The digital services and technology space is highly competitive. Bigger IT and tech players may outbid or outperform Cressanda in winning key contracts. -

Limited Historical Track Record in Tech Expansion

While Cressanda is entering new areas like AI, digital media, and smart infrastructure, it has a limited track record compared to established players. -

Dependence on Strategic Partnerships

Success of upcoming ventures depends heavily on partnerships and acquisitions. If these do not deliver expected results, growth may slow down. -

Stock Volatility and Investor Sentiment

As a small-cap company, Cressanda’s stock may face sharp ups and downs based on market trends, news, or rumors, affecting investor confidence.

Shareholding Pattern For Cressanda Solutions Share

| Held By | Mar 2025 |

| Promoters | 0.07% |

| Flls | 0% |

| Dlls | 0.02% |

| Public | 99.91% |

Cressanda Solutions Financials

| (INR) | Mar 2024 | Y/Y change |

| Revenue | 2.05B | 135.90% |

| Operating expense | 134.11M | 237.32% |

| Net income | 137.30M | 125.80% |

| Net profit margin | 6.71 | -4.28% |

| Earnings per share | — | — |

| EBITDA | 106.87M | 157.82% |

| Effective tax rate | 11.45% | — |

Read Also:- NCC Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview