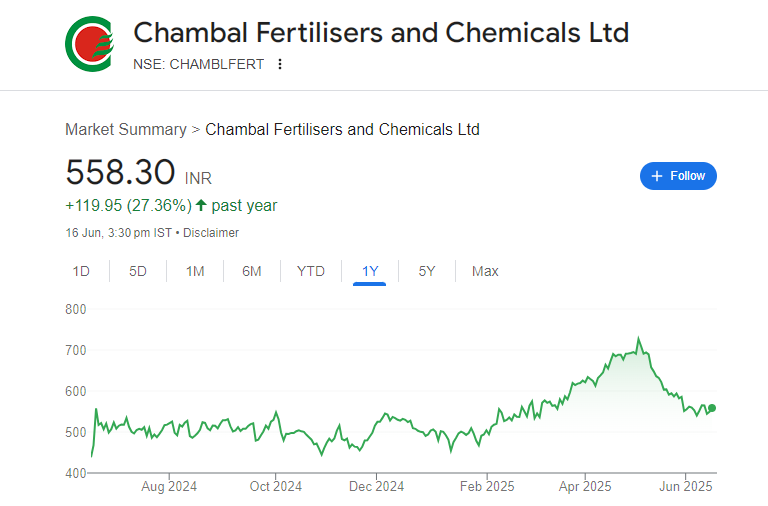

Chambal Fertilisers & Chemicals Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview

Chambal Fertilisers & Chemicals is one of India’s leading fertiliser companies, trusted by millions of farmers across the country. Known for its quality products and farmer-friendly approach, Chambal plays a big role in helping Indian agriculture grow stronger. The company has built a solid reputation by delivering reliable crop solutions, supporting sustainable farming, and expanding into new agri-innovations. Chambal Fertilisers & Chemicals Share Price on NSE as of 17 June 2025 is 558.30 INR. This article will provide more details on Chambal Fertilisers & Chemicals Share Price Target 2025, 2026 to 2030.

Chambal Fertilisers & Chemicals Ltd: Company Info

- Founded: 1985

- Headquarters: India

- Number of employees: 1,089 (2024)

- Parent organization: Adventz Investments and Holdings Limited

- Revenue: 27,940 crores INR (US$3.5 billion, FY23)

- Subsidiaries: CFCL Ventures Limited, ISGN Technologies.

Chambal Fertilisers & Chemicals Share Price Chart

Chambal Fertilisers & Chemicals Share: Market Overview

- Open: 549.45

- High: 559.80

- Low: 541.00

- Mkt cap: 22.37KCr

- P/E ratio: 13.56

- Div yield: N/A

- 52-wk high: 742.20

- 52-wk low: 422.50

Chambal Fertilisers & Chemicals Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Chambal Fertilisers & Chemicals for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹750

- 2026 – ₹790

- 2027 – ₹830

- 2028 – ₹870

- 2029 – ₹910

- 2030 – ₹950

Chambal Fertilisers & Chemicals Share Price Target 2025

Chambal Fertilisers & Chemicals share price target 2025 Expected target could be between ₹740 to ₹750. Here are 7 key factors that could influence the growth of Chambal Fertilisers & Chemicals’ share price by 2025:

1. Strong Fertiliser Production & Sales Volume

In Q3 FY25, Chambal recorded a 16% YoY increase in EBITDA (₹843 cr) and a 25% rise in PAT (₹505 cr), driven by higher production (9.18 LMT) and sales (9.88 LMT) of urea.

2. Growth in Crop Protection & Specialty Nutrients

The Crop Protection Chemicals (CPC) and Specialty Nutrients (SN) segments grew ~26% YoY in Q3, contributing ₹255 cr revenue and ₹68 cr EBITDA—highlighting diversification beyond urea.

3. Backward Integration through Phosphates & TAN

Ongoing investments include expanding phosphoric acid capacity (5 → 7 LMT) and setting up a Technical Ammonium Nitrate (TAN) plant, which will strengthen margins and reduce dependency on imports.

4. Robust Financial Health & Subsidy Clarity

A net cash position of ~₹3,000 cr and timely subsidy receipts (₹3,350 cr in Q3) support liquidity and operations, reducing funding risk.

5. Sustainability & R&D Investments

Collaboration with TERI and plans for hybrid seeds and biological crop solutions (like biological fungicides and nematode controls) support future growth in sustainable agriculture.

6. Strategic Alliances & Market Reach

Chambal is expanding its CPC/SN portfolio (64 products across 13 states), enhancing farmer outreach and deepening distribution—expected to lift revenues in new agri-input categories.

7. Valuation Gap & Buyback Strategy

Trading at a P/E of ~11x (versus market average ~20x), and with announced buyback plans, Chambal remains attractively valued—offering scope for re-rating if sector performance remains strong.

Chambal Fertilisers & Chemicals Share Price Target 2030

Chambal Fertilisers & Chemicals share price target 2030 Expected target could be between ₹940 to ₹950. Here are 7 key risks and challenges that could impact Chambal Fertilisers & Chemicals’ share price by 2030:

1. Dependence on Government Subsidies

A large part of Chambal’s revenue comes from government subsidies on urea. Delays in subsidy payments or policy changes can affect cash flow and working capital.

2. Volatility in Global Raw Material Prices

Chambal depends on imported raw materials like natural gas, phosphoric acid, and ammonia. Any global price hike or supply chain disruptions could increase production costs.

3. Declining Urea Demand Over Time

India is encouraging balanced fertilizer use (NPK) and organic alternatives. A long-term shift away from urea could reduce Chambal’s main revenue stream unless it diversifies effectively.

4. Regulatory and Environmental Pressure

Fertilizer manufacturing is energy-intensive and can lead to pollution. Stricter environmental norms or carbon emission regulations may raise compliance costs.

5. Competition from Domestic & Global Players

Chambal faces strong competition from other Indian players like RCF, IFFCO, and GSFC, as well as foreign companies in the crop protection and specialty nutrients space.

6. Capital Allocation and Project Execution Risks

The success of Chambal’s investments (like the TAN plant and phosphate expansion) depends on timely execution and market acceptance. Delays or cost overruns may affect returns.

7. Innovation & R&D Lag

As the agri-input market evolves, failure to innovate with bio-fertilizers, nano-urea, or precision agri-tech could leave Chambal behind emerging trends and new entrants.

Shareholding Pattern For Chambal Fertilisers & Chemicals Share

| Held By | May 2025 |

| Promoters | 60.4% |

| Flls | 20.19% |

| Dlls | 4.59% |

| Public | 14.82% |

Chambal Fertilisers & Chemicals Financials

| (INR) | 2025 | Y/Y change |

| Revenue | 166.46B | -7.35% |

| Operating expense | 51.77B | -1.26% |

| Net income | 16.50B | 29.29% |

| Net profit margin | 9.91 | 39.58% |

| Earnings per share | 41.17 | 33.50% |

| EBITDA | 24.83B | 20.44% |

| Effective tax rate | 32.72% | — |

Read Also:- Reliance Power Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview