Anant Raj Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials

Anant Raj Limited is a well-known real estate and infrastructure company in India, with a strong presence in Delhi-NCR. It has earned the trust of homebuyers and investors by delivering high-quality residential, commercial, and industrial projects. The company is also expanding into modern areas like data centers and digital infrastructure, showing its forward-thinking approach. Anant Raj Share Price on NSE as of 19 June 2025 is 526.50 INR. This article will provide more details on Anant Raj Share Price Target 2025, 2026 to 2030.

Anant Raj Ltd: Company Info

- Headquarters: India

- Number of employees: 204 (2024)

- Subsidiaries: Grandstar Realty Private Limited .

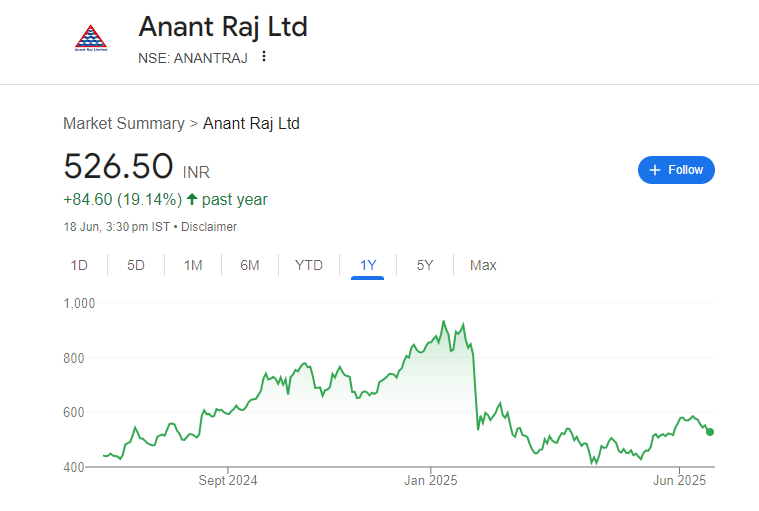

Anant Raj Share Price Chart

Anant Raj Share: Market Overview

- Open: 534.30

- High: 545.50

- Low: 523.40

- Mkt cap: 18.16KCr

- P/E ratio: 42.36

- Div yield: 0.14%

- 52-wk high: 947.90

- 52-wk low: 376.15

Anant Raj Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Anant Raj for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹960

- 2026 – ₹1080

- 2027 – ₹1210

- 2028 – ₹1305

- 2029 – ₹1420

- 2030 – ₹1500

Anant Raj Share Price Target 2025

Anant Raj share price target 2025 Expected target could be between ₹950 to ₹960. Here are 7 key factors that could drive the growth of Anant Raj’s share price by 2025:

-

Robust Real Estate & Infrastructure Expansion

Anant Raj continues to benefit from strong demand in residential and commercial real estate, supported by favorable urbanization trends and government-led infrastructure development. -

Rapid Revenue & Profit Growth

The company has seen an impressive rise in both sales and profit—net sales surged from ₹250 cr (2021) to ₹2,060 cr (2025), with PAT jumping from ₹0.2 cr to ₹421 cr—highlighting effective execution. -

Entry Into Data Centers & Cloud

Through its Anant Raj Cloud arm, the company is expanding into data center assets (now at 28 MW IT load), tapping into fast-growing digital infrastructure demand. -

Strategic Land Bank in NCR

Owning over 300 acres in Gurgaon and Delhi, the firm has a strong land asset base. This long pipeline supports revenue visibility and future development. -

Debt Reduction & Strong Financial Health

The company has significantly cut down liabilities (now net-debt free by late 2024), improving margins, reducing risks, and strengthening its balance sheet. -

Analyst Upgrades & Strong Valuation Sentiment

Brokerages like Motilal Oswal and Emkay remain bullish, with price targets ranging from ₹750–1,085, signaling analyst confidence and potential upside . -

Technology & Innovation Focus

A continued investment in innovation and sustainability—backed by solid R&D and smart building projects—supports differentiation and future growth.

Anant Raj Share Price Target 2030

Anant Raj share price target 2030 Expected target could be between ₹1490 to ₹1500. Here are 7 key risks and challenges that could impact Anant Raj’s share price growth by 2030:

-

Real Estate Market Cycles

Anant Raj’s core business is real estate, which is affected by property cycles. A slowdown in housing demand, high interest rates, or changes in buyer sentiment could directly impact its sales and profits. -

Regulatory and Policy Risks

Real estate and infrastructure are highly regulated sectors. Changes in land acquisition laws, construction norms, environmental clearances, or tax rules could delay or affect ongoing and future projects. -

Execution Risk in Large-Scale Projects

The company is involved in several large residential and commercial developments. Any delays, cost overruns, or project mismanagement could reduce investor confidence and slow revenue growth. -

Rising Input and Construction Costs

Inflation in the prices of raw materials like steel, cement, and labor can raise construction costs, affecting margins and making projects less profitable if not passed on to buyers. -

Dependence on NCR Region

A large portion of Anant Raj’s land bank and business is concentrated in Delhi-NCR. Any regional slowdown, policy changes, or regulatory hurdles in this area may pose a serious growth risk. -

High Competition in Real Estate and Data Centers

The company faces strong competition in both real estate (from established builders) and data center development (from tech-focused firms). This could impact market share and profitability. -

Economic and Global Uncertainty

A wider economic slowdown, geopolitical tensions, or disruptions in the financial markets could reduce investor activity in real estate and delay customer decisions, especially in the premium segment.

Shareholding Pattern For Anant Raj Share

| Held By | May 2025 |

| Promoters | 60.16% |

| Flls | 12.88% |

| Dlls | 6.57% |

| Public | 20.39% |

Anant Raj Financials

| (INR) | 2025 | Y/Y change |

| Revenue | 20.60B | 38.88% |

| Operating expense | 1.16B | 32.48% |

| Net income | 4.26B | 63.10% |

| Net profit margin | 20.66 | 17.45% |

| Earnings per share | 12.43 | — |

| EBITDA | 4.92B | 47.29% |

| Effective tax rate | 13.94% | — |

Read Also:- Astra Microwave Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview