Alok Industries Share Price Target Tomorrow From 2025 To 2030- Market Overview, Current Chart

Alok Industries is one of India’s well-known textile companies, offering a wide range of products like yarn, fabric, garments, and home textiles. The company is backed by Reliance Industries, which gives it strong financial and operational support. Alok has a fully integrated setup—from raw materials to finished products—which helps maintain quality and control costs. Its products are sold in both Indian and international markets. Alok Industries Share Price on NSE as of 11 June 2025 is 20.92 INR. This article will provide more details on Alok Industries Share Price Target 2025, 2026 to 2030.

Alok Industries Ltd: Company Info

- Founded: 1986

- Headquarters: Mumbai, Maharashtra

- Number of employees: 22,245 (2024)

- Parent organization: Reliance Industries

- Revenue: 7,150.91 crores INR (US$900 million, 2022)

- Subsidiaries: Store Twenty One, Alok Infrastructure Limited.

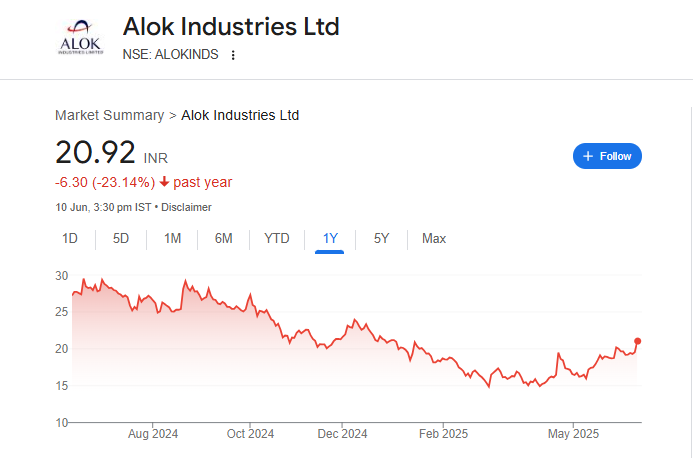

Alok Industries Share Price Chart

Alok Industries Share: Market Overview

- Open: 19.57

- High: 21.40

- Low: 19.49

- Mkt cap: 10.41KCr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 30.00

- 52-wk low: 14.01

Alok Industries Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Alok Industries for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹40

- 2026 – ₹50

- 2027 – ₹60

- 2028 – ₹70

- 2029 – ₹80

- 2030 – ₹90

Alok Industries Share Price Target 2025

Alok Industries share price target 2025 Expected target could be between ₹30 to ₹40. Here are 7 key factors affecting the growth of Alok Industries’ share price toward 2025:

-

Reliance Group Backing

With Reliance Industries now holding a ~75% stake, Alok has access to strong financial support and industrial synergies. -

Expanding Spinning Capacity

The recent expansion of Spinning Unit 4 adds modern, efficient capacity—boosting overall production and improving margins. -

Integrated Polyester-to-Textiles Model

Alok’s full value-chain setup—from polyester chips to fabrics and apparel—helps control costs, delivers quality, and increases profitability. -

Global Market Reach

The company exports to over 90 countries and operates a European subsidiary (Mileta), providing access to international demand. -

Leadership & Tech Partnerships

Reliance’s leadership (e.g., new CEO & COO) together with tech tie-ups (like Rieter for automation) strengthen operations and strategic direction. -

Sustainability & Eco-Friendly Products

Alok is launching eco-conscious lines (e.g., organic cotton, bamboo, recycled yarns) meeting growing global demand for sustainable textiles. -

Trend Reversal & Financial Improvements

After facing losses, Alok has cut its net loss significantly (Q4FY25: ₹74 cr vs. ₹273 cr in Q3FY25) and shares rebounded ~18% on improved performance and leadership revamp.

Alok Industries Share Price Target 2030

Alok Industries share price target 2030 Expected target could be between ₹80 to ₹90. Here are 7 key risks and challenges that could affect Alok Industries’ share price by 2030:

-

High Debt Levels

Alok Industries has a history of financial stress and was previously under insolvency proceedings. Any rise in debt or interest costs in the future could hurt profitability and investor confidence. -

Global Textile Market Uncertainty

The textile industry is cyclical and highly sensitive to global economic slowdowns, trade tensions, and changing consumer demand. A drop in international orders could impact earnings. -

Raw Material Price Fluctuations

Prices of key inputs like cotton, polyester, and dyes are volatile. Sharp cost increases can reduce profit margins if not passed on to customers. -

Intense Industry Competition

Alok faces tough competition from both Indian and global textile players. Competing on quality, price, and innovation requires constant investment and efficiency. -

Environmental and Sustainability Regulations

With increasing focus on sustainability, Alok may need to invest more in eco-friendly processes. Failure to meet environmental norms could lead to fines or loss of export orders. -

Operational Challenges in Scaling Up

Expanding and modernizing operations across such a large product portfolio may lead to delays, quality issues, or inefficiencies if not managed well. -

Reliance on Parent Company (Reliance Industries)

While Reliance’s support is a strength, over-dependence on its strategic direction or resource allocation may limit Alok’s independence and flexibility.

Shareholding Pattern For Alok Industries Share

| Held By | Mar 2025 |

| Promoters | 75% |

| Flls | 2.4% |

| Dlls | 0.43% |

| Public | 22.17% |

Alok Industries Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 37.09B | -32.69% |

| Operating expense | 14.03B | -29.83% |

| Net income | -8.16B | 3.59% |

| Net profit margin | -22.01 | -43.20% |

| Earnings per share | — | — |

| EBITDA | -893.90M | -275.31% |

| Effective tax rate | -0.62% | — |

Read Also:- Integra Essentia Share Price Target Tomorrow From 2025 To 2030- Market Overview, Financials