Adani Port Share Price Target Tomorrow From 2025 To 2030- Market Overview, Current Chart

Adani Port, officially known as Adani Ports and Special Economic Zone (APSEZ), is India’s largest private port operator. Known for its world-class infrastructure and efficient services, it plays a key role in connecting India to global trade. From handling cargo to offering smart logistics solutions, Adani Port is helping the country grow stronger in international business. Adani Port Share Price on NSE as of 05 June 2025 is 1,434.30 INR. This article will provide more details on Adani Port Share Price Target 2025, 2026 to 2030.

Adani Ports and Special Economic Zone Ltd: Company Info

- Founded: 26 May 1998

- Founder: Gautam Adani

- Headquarters: India

- Number of employees: 3,118 (2025)

- Parent organization: Adani Group

- Subsidiaries: Marine Infrastructure Developer Private Limited.

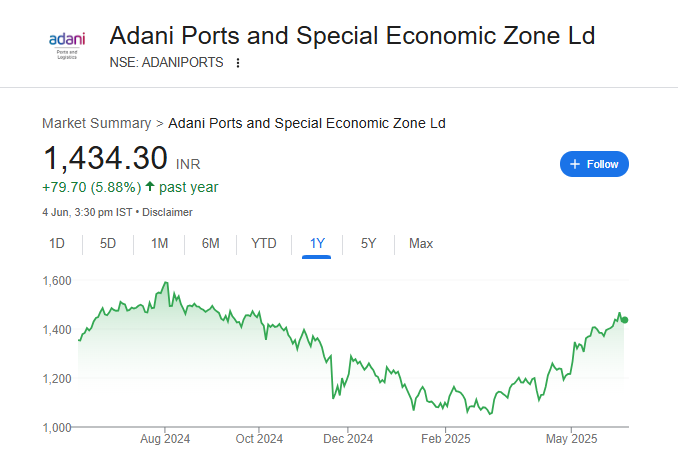

Adani Port Share Price Chart

Adani Port Share: Market Overview

- Open: 1,432.30

- High: 1,441.10

- Low: 1,423.10

- Mkt cap: 3.11LCr

- P/E ratio: 27.93

- Div yield: 0.49%

- 52-wk high: 1,604.95

- 52-wk low: 995.65

Adani Port Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Adani Port for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹1610

- 2026 – ₹1700

- 2027 – ₹1800

- 2028 – ₹1900

- 2029 – ₹2000

- 2030 – ₹2100

Adani Port Share Price Target 2025

Adani Port share price target 2025 Expected target could be between ₹1600 to ₹1610. Here are 7 key factors affecting the growth of Adani Ports and Special Economic Zone (APSEZ) share price target for 2025:

-

Strategic Port Locations

Adani Ports operates some of India’s most important ports, located on key trade routes, giving it a strong advantage in handling cargo traffic. -

Rising Trade and Export-Import Volume

Growth in India’s international trade, especially exports and imports, boosts cargo volumes, which directly benefits the company’s revenue. -

Expansion of Port Capacity

Ongoing investments in expanding existing ports and building new ones help increase operational scale and long-term growth. -

Diversification into Logistics and Warehousing

Adani Ports is expanding into end-to-end logistics, which helps improve efficiency, customer service, and revenue streams. -

Private and Global Partnerships

Collaborations with global shipping lines and logistic companies improve business reach and operational excellence. -

Government Push for Infrastructure Growth

Policies like Sagarmala and Make in India support port-led development, bringing more business to players like Adani Ports. -

Technology and Automation

Use of modern technology, automation, and digital tools increases efficiency, reduces costs, and attracts global clients.

Adani Port Share Price Target 2030

Adani Port share price target 2030 Expected target could be between ₹2100 to ₹2120. Here are 7 key risks and challenges that could affect Adani Ports’ share price target by 2030:

-

Regulatory and Policy Risks

Changes in government regulations, environmental policies, or port tariffs could impact operations and future earnings. -

Dependence on Global Trade

As Adani Ports relies heavily on import-export activity, global slowdowns, wars, or trade restrictions can reduce cargo volumes. -

High Debt Levels

Continued expansion and acquisitions involve large investments. If not managed properly, high debt could pressure financial stability. -

Environmental Concerns

Port and infrastructure projects often face resistance due to environmental issues, which can cause delays or legal hurdles. -

Geopolitical Tensions

International conflicts or maritime disruptions (e.g., tensions in the Red Sea or South China Sea) can affect shipping and logistics flows. -

Rising Competition

Increasing competition from other Indian and international ports may affect market share and pricing power. -

Reputation and Group-Level Risks

As part of the Adani Group, any controversy or financial trouble within the group can impact investor sentiment and share performance.

Shareholding Pattern For Adani Port Share

| Held By | Mar 2025 |

| Promoters | 65.89% |

| Flls | 13.43% |

| Dlls | 14.73% |

| Public | 5.95% |

Adani Port Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 304.75B | 14.09% |

| Operating expense | 61.75B | 12.34% |

| Net income | 110.92B | 36.76% |

| Net profit margin | 36.40 | 19.89% |

| Earnings per share | 52.33 | 34.39% |

| EBITDA | 180.93B | 15.51% |

| Effective tax rate | 15.11% | — |

Read Also:- Adani Green Share Price Target Tomorrow From 2025 To 2030- Current Graph, Market Overview