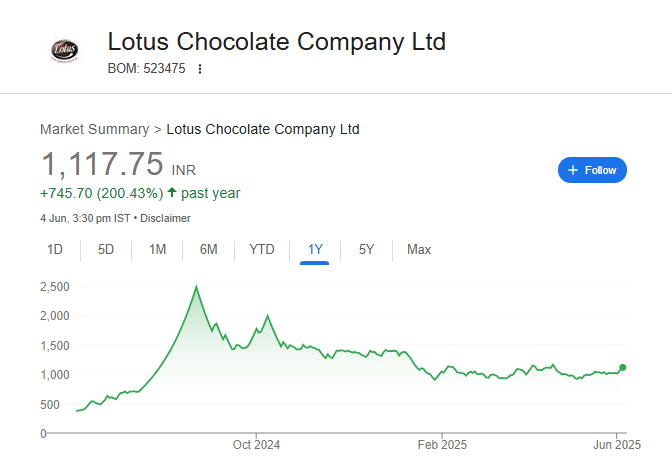

Lotus Chocolate Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview

Lotus Chocolate is a growing name in India’s sweet world, known for making delicious and affordable chocolates that bring joy to every bite. With a strong focus on quality and taste, the company has earned love from kids and adults alike. Now backed by the powerful Reliance Group, Lotus Chocolate is all set to expand its reach and create new favorites for the Indian market. Lotus Chocolate Share Price on NSE as of 05 June 2025 is 1,117.75 INR. This article will provide more details on Lotus Chocolate Share Price Target 2025, 2026 to 2030.

Lotus Chocolate Ltd: Company Info

- Founded: 1988

- Headquarters: India

- Number of employees: 85 (2024)

- Parent organization: Reliance Consumer Products Limited

- Subsidiary: Soubhagya Confectionery Private Limited.

Lotus Chocolate Share Price Chart

Lotus Chocolate Share: Market Overview

- Open: 1,095.60

- High: 1,117.75

- Low: 1,073.70

- Mkt cap: 1.44KCr

- P/E ratio: 83.29

- Div yield: N/A

- 52-wk high: 2,608.65

- 52-wk low: 305.20

Lotus Chocolate Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Lotus Chocolate for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹2610

- 2026 – ₹3840

- 2027 – ₹4580

- 2028 – ₹5400

- 2029 – ₹6120

- 2030 – ₹7040

Lotus Chocolate Share Price Target 2025

Lotus Chocolate share price target 2025 Expected target could be between ₹2600 to ₹2610. Here are 7 key factors affecting the growth of Lotus Chocolate’s share price target for 2025:

-

Rising Demand for Chocolates in India

The Indian market is seeing a strong rise in chocolate consumption, especially among youth and urban populations, boosting company sales. -

Partnership with Reliance Group

With Reliance investing in Lotus Chocolate, the company now has stronger financial backing and access to a wider distribution network. -

Expansion in Retail and E-commerce

Growing presence in retail stores and online platforms is helping Lotus reach more customers across the country. -

New Product Launches

Introducing new flavors, packaging, and premium products can attract a larger customer base and improve brand image. -

Growing Middle-Class and Gifting Culture

Increased disposable income and chocolate becoming a popular gifting item are contributing to higher demand. -

Brand Positioning and Marketing

Better advertising, packaging, and visibility can enhance brand appeal, especially to children and young adults. -

Export Opportunities

With quality products and increased production capacity, Lotus Chocolate has potential to expand into international markets.

Lotus Chocolate Share Price Target 2030

Lotus Chocolate share price target 2030 Expected target could be between ₹7020 to ₹7040. Here are 7 key risks and challenges that could affect Lotus Chocolate’s share price target by 2030:

-

High Market Competition

Big brands like Cadbury, Nestlé, and Amul dominate the chocolate market. Competing with them can be tough for a smaller brand like Lotus. -

Fluctuation in Raw Material Prices

Prices of key ingredients like cocoa, sugar, and milk can rise due to global supply issues, which can reduce profit margins. -

Changing Consumer Preferences

If customers shift towards healthier or sugar-free options, Lotus may need to adapt quickly or risk losing market share. -

Dependence on Limited Product Range

Heavy focus on chocolates without much diversification may make the business vulnerable if chocolate demand drops. -

Brand Awareness Challenges

Compared to well-established chocolate brands, Lotus still has a limited brand recall, which may slow down its growth. -

Supply Chain and Distribution Issues

Any problems in logistics, especially during festive seasons or in rural areas, can affect timely delivery and sales. -

Economic Slowdowns or Inflation

In tough economic times, consumers may reduce spending on non-essential items like chocolates, affecting sales volumes.

Shareholding Pattern For Lotus Chocolate Share

| Held By | Mar 2025 |

| Promoters | 72.07% |

| Flls | 0.08% |

| Dlls | 0.02% |

| Public | 27.83% |

Lotus Chocolate Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 5.74B | 186.83% |

| Operating expense | 564.01M | 107.97% |

| Net income | 172.27M | 240.78% |

| Net profit margin | 3.00 | 18.58% |

| Earnings per share | — | — |

| EBITDA | 311.69M | 863.83% |

| Effective tax rate | 25.28% | — |

Read Also:- NBCC Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials