Paytm Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials

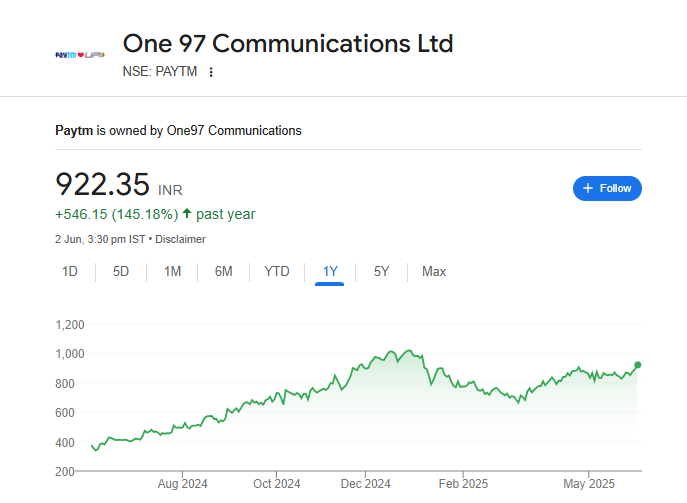

Paytm is one of India’s most popular digital payment platforms, trusted by millions for fast, easy, and secure transactions. Whether it’s paying bills, shopping online, booking tickets, or sending money, Paytm makes everyday life simpler. Users love its smooth experience, cashback offers, and wide range of services. Paytm Share Price on NSE as of 03 June 2025 is 922.35 INR. This article will provide more details on Paytm Share Price Target 2025, 2026 to 2030.

One 97 Communications Ltd: Company Info

- CEO: Vijay Shekhar Sharma (2000–)

- Founder: Vijay Shekhar Sharma

- Headquarters: Noida

- Number of employees: 43,960 (2024)

- Subsidiaries: Paytm, Paytm Money Limited, Paytm E-Commerce.

Paytm Share Price Chart

Paytm Share: Market Overview

- Open: 888.90

- High: 929.00

- Low: 883.65

- Mkt cap: 58.95KCr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 1,062.95

- 52-wk low: 339.55

Paytm Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Paytm for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹1070

- 2026 – ₹1500

- 2027 – ₹2000

- 2028 – ₹2500

- 2029 – ₹3000

- 2030 – ₹3500

Paytm Share Price Target 2025

Paytm share price target 2025 Expected target could be between ₹1050 to ₹1070. Here are 7 key factors affecting the growth of Paytm’s share price target for 2025:

-

Growth in Digital Payments

As more people in India use digital wallets and UPI, Paytm can benefit from increased transactions and user activity. -

Expansion of Financial Services

Paytm is growing in areas like loans, insurance, and wealth management. These services can boost revenue and long-term growth. -

Rising Merchant Adoption

More small businesses and stores are using Paytm for payments and QR codes. This helps increase the company’s transaction volume and customer base. -

Strong User Base

A large and active user base allows Paytm to cross-sell products, such as credit services or investment tools, and generate more income. -

Partnerships and Ecosystem Growth

Collaborations with banks, NBFCs, and other companies help Paytm expand its services and reach more users. -

Focus on Profitability

The company is working on reducing losses and improving margins, which is important for long-term investor confidence and share price growth. -

Supportive Digital India Push

Government support for a cashless economy and digital infrastructure can help Paytm grow faster in the fintech space.

Paytm Share Price Target 2030

Paytm share price target 2030 Expected target could be between ₹3470 to ₹3500. Here are 7 key risks and challenges that could affect Paytm’s share price target by 2030:

-

Strict Regulatory Changes

New rules from the RBI or government (like the recent license cancellations) can limit Paytm’s financial services and hurt business operations. -

Tough Competition

Strong competitors like Google Pay, PhonePe, Amazon Pay, and new fintech startups could reduce Paytm’s market share. -

Trust and Reputation Issues

Any data leak, service failure, or regulatory penalty can damage user trust and impact customer retention. -

Slow Path to Profitability

If Paytm takes too long to turn consistent profits, it may reduce investor confidence and affect the stock’s future performance. -

Dependence on Third-Party Financial Partners

Paytm relies on partnerships with banks and NBFCs for loans and insurance. Any problem with these partners can impact services. -

Cybersecurity Threats

As a digital platform, Paytm faces high risks of hacking and fraud. A major breach could lead to financial and reputational damage. -

Unstable Market Sentiment

Tech and fintech stocks are often very sensitive to market trends and investor emotions, which can lead to high share price volatility.

Shareholding Pattern For Paytm Share

| Held By | Mar 2025 |

| Promoters | 0% |

| Flls | 55.4% |

| Dlls | 14% |

| Public | 30.6% |

Paytm Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 69.00B | -30.84% |

| Operating expense | 36.67B | 0.31% |

| Net income | -6.59B | 53.51% |

| Net profit margin | -9.55 | 32.75% |

| Earnings per share | -23.29 | -1.65% |

| EBITDA | -15.07B | -55.17% |

| Effective tax rate | -2.79% | — |

Read Also:- Asian Paints Share Price Target Tomorrow From 2025 To 2030- Market Overview, Financials