Sun Pharma Share Price Target Tomorrow From 2025 To 2030- Current Graph, Market Overview

Sun Pharmaceutical Industries is one of India’s most trusted and leading pharmaceutical companies. It is known for making high-quality medicines that help people live healthier lives, both in India and around the world. From treating everyday illnesses to serious health conditions, Sun Pharma provides a wide range of affordable and effective treatments. Many patients and doctors rely on its products for their safety and results. Sun Pharma Share Price on NSE as of 31 May 2025 is 1,674.90 INR. This article will provide more details on Sun Pharma Share Price Target 2025, 2026 to 2030.

Sun Pharmaceutical Industries Ltd: Company Info

- Founder: Dilip Shanghvi

- Headquarters: Goregaon, Mumbai

- Number of employees: 43,000 (2024)

- Revenue: 44,520 crores INR (US$5.6 billion, 2023)

- Subsidiaries: Taro Pharmaceutical Industries Ltd.

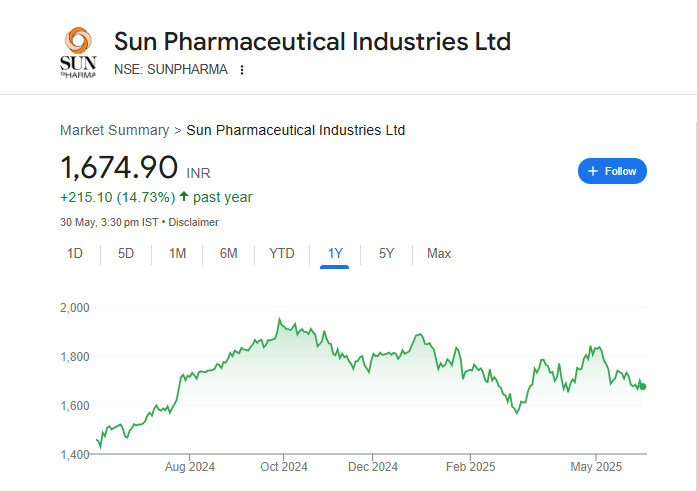

Sun Pharma Share Price Chart

Sun Pharma Share: Market Overview

- Open: 1,702.00

- High: 1,713.60

- Low: 1,669.10

- Mkt cap: 4.03LCr

- P/E ratio: 35.50

- Div yield: 0.96%

- 52-wk high: 1,960.35

- 52-wk low: 1,377.20

Sun Pharma Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Sun Pharma for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹1970

- 2026 – ₹2250

- 2027 – ₹2487

- 2028 – ₹2735

- 2029 – ₹2967

- 2030 – ₹3115

Sun Pharma Share Price Target 2025

Sun Pharma share price target 2025 Expected target could be between ₹1950 to ₹1970. Here are seven key factors influencing the growth of Sun Pharmaceutical Industries’ share price target for 2025:

-

Robust Domestic Market Performance

Sun Pharma’s India formulations segment reported a 13.6% year-on-year growth in Q4 FY25, with sales reaching ₹4,213 crore. The company maintained its No. 1 position in the Indian pharmaceutical market, increasing its market share from 8.0% to 8.3% as per the AIOCD AWACS MAT March-2025 report. -

Expansion in Global Specialty Business

The global specialty segment, which includes treatments for chronic conditions like psoriasis and hair loss, saw a 17.1% year-on-year growth in FY25, with sales totaling $1,216 million. This segment accounted for 19.9% of total consolidated sales in Q4 FY25, reflecting its growing contribution to the company’s revenue. -

Strategic Acquisitions Enhancing Portfolio

In March 2025, Sun Pharma acquired U.S.-based Checkpoint Therapeutics for $355 million. This acquisition aims to expand Sun Pharma’s oncology and immunotherapy portfolio, adding FDA-approved treatments like UNLOXCYT for advanced skin cancer to its offerings. -

Increased R&D Investment

The company invested ₹3,248.4 crore in R&D during FY25, representing 6.2% of its sales. This investment supports the development of both specialty and generic products, positioning Sun Pharma for sustainable long-term growth. -

Positive Analyst Outlook

Brokerage firms like JM Financial and Emkay Global Financial Services have maintained a ‘Buy’ rating on Sun Pharma, with target prices of ₹2,025 and ₹2,250 respectively. These ratings reflect confidence in the company’s growth prospects across key segments. -

Emerging Markets and RoW Growth

Sales in Emerging Markets and Rest of World (RoW) regions grew by 7.0% and 4.5% respectively in FY25. These markets contributed significantly to the company’s overall revenue, indicating successful expansion beyond traditional markets. -

Development of Innovative Therapies

Sun Pharma is developing an experimental anti-obesity and type 2 diabetes drug, Utreglutide (GL0034), aiming for a global launch within five years. This initiative aligns with the company’s strategy to enter high-growth therapeutic areas and diversify its product portfolio.

Sun Pharma Share Price Target 2030

Sun Pharma share price target 2030 Expected target could be between ₹1300 to ₹3115. Here are seven key risks and challenges that could impact Sun Pharmaceutical Industries’ share price target by 2030:

-

Patent Expirations and Generic Competition

Sun Pharma faces the challenge of patent expirations for several of its branded drugs by 2030. Once patents expire, generic competitors can enter the market, potentially leading to significant revenue declines. This phenomenon, often referred to as the “patent cliff,” is a common issue in the pharmaceutical industry. -

Regulatory Compliance Risks

Operating in multiple countries exposes Sun Pharma to various regulatory environments. Non-compliance with regulatory standards can lead to sanctions, product recalls, or delays in drug approvals, adversely affecting the company’s reputation and financial performance. -

Pricing Pressures in Key Markets

Sun Pharma is subject to pricing pressures, especially in regulated markets like the U.S. and Europe. Government initiatives to reduce healthcare costs can lead to price reductions for pharmaceutical products, impacting the company’s profit margins. -

Geopolitical and Supply Chain Disruptions

Global geopolitical tensions and events such as pandemics can disrupt supply chains, affecting the availability of raw materials and the distribution of finished products. Such disruptions can lead to increased operational costs and impact the company’s ability to meet market demand. -

Environmental and Climate Change Risks

Sun Pharma’s operations are susceptible to environmental risks, including extreme weather events and climate change impacts. These factors can disrupt manufacturing processes and supply chains, leading to potential financial losses. -

Cybersecurity Threats

As with many large organizations, Sun Pharma faces the risk of cyberattacks, which can compromise sensitive data, disrupt operations, and lead to financial and reputational damage. Ensuring robust cybersecurity measures is essential to mitigate this risk. -

Challenges in Research and Development (R&D)

Developing new pharmaceutical products involves significant investment and uncertainty. Failures in clinical trials or delays in product development can hinder the company’s growth prospects and affect investor confidence.

Shareholding Pattern For Sun Pharma Share

| Held By | Mar 2025 |

| Promoters | 54.48% |

| Flls | 17.96% |

| Dlls | 18.7% |

| Public | 8.87% |

Sun Pharma Financials

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 525.78B | 8.42% |

| Operating expense | 293.20B | 10.50% |

| Net income | 109.29B | 14.12% |

| Net profit margin | 20.79 | 5.27% |

| Earnings per share | 47.86 | 14.79% |

| EBITDA | 150.86B | 17.16% |

| Effective tax rate | 20.18% | — |