Belrise Industries Share Price Target Tomorrow From 2025 To 2030- Current Chart, Financials

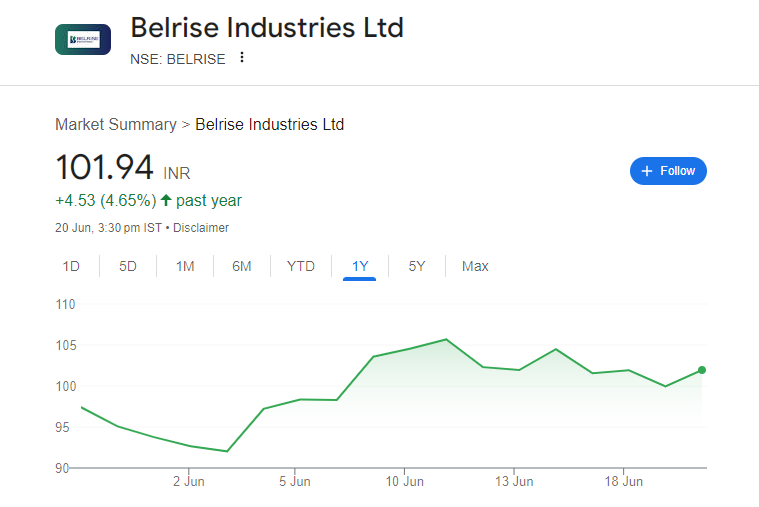

Belrise Industries Ltd. is a fast-growing auto components company in India, known for providing high-quality parts to some of the top vehicle manufacturers. The company offers a wide range of products made from metal and polymer, serving both traditional and electric vehicles. Customers trust Belrise for its reliable performance, modern technology, and timely delivery. Belrise Industries Share Price on NSE as of 21 June 2025 is 101.94 INR. This article will provide more details on Belrise Industries Share Price Target 2025, 2026 to 2030.

Belrise Industries Ltd: Company Info

- Founded: 1988

- Headquarters: India

- Number of employees: 2,144 (2024)

- Subsidiaries: Hop Electric Manufacturing Private Limited, H-One India PVT. Ltd.

Belrise Industries Share Price Chart

Belrise Industries Share: Market Overview

- Open: 100.00

- High: 102.50

- Low: 99.50

- Mkt cap: 9.08KCr

- P/E ratio: 35.05

- Div yield: N/A

- 52-wk high: 109.00

- 52-wk low: 89.15

Belrise Industries Share Price Target Tomorrow From 2025 To 2030

Here are the estimated share prices of Belrise Industries for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

- 2025 – ₹110

- 2026 – ₹130

- 2027 – ₹150

- 2028 – ₹170

- 2029 – ₹190

- 2030 – ₹210

Belrise Industries Share Price Target 2025

Belrise Industries share price target 2025 Expected target could be between ₹107 to ₹110. Here are 7 key factors that could drive Belrise Industries’ share price growth by 2025:

-

Strong Q4 Profit Surge

Belrise reported a impressive more than five-fold increase in net profit for the March quarter, sending shares up ~7% on solid earnings momentum. -

Strategic Acquisition & Product Expansion

The acquisition of H-One India broadens Belrise’s portfolio beyond metal and polymer components—adding suspension systems and mirrors—helping tap into new OEM segments. -

Leading Market Position in 2‑Wheeler Components

With around 24% market share in India’s 2-wheeler metal components segment and a strong client base of 29 OEMs (e.g., Bajaj, Honda), Belrise is well-positioned to ride industry growth. -

EV‑Agnostic Product Portfolio

The company’s products work across both ICE and electric vehicles. Orders for EV-specific components grew at a ~24% CAGR from FY22-24, future-proofing its business. -

IPO Boost: Debt Reduction & Capital Raise

IPO proceeds (around ₹2,150 cr) will help reduce debt and fund future expansion. Listing debut at ~11% premium reflects strong market sentiment. -

Robust Production & Tech Integration

With 17 vertically-integrated plants across India, IoT and automation (700+ robots), and JIT capabilities, Belrise ensures consistent quality and efficient delivery. -

Competitive Valuation vs. Peers

Despite strong growth, Belrise’s IPO pricing offered a lower valuation—P/E ~17–25×—compared to peers, making it attractive for long-term investors.

Belrise Industries Share Price Target 2030

Belrise Industries share price target 2030 Expected target could be between ₹206 to ₹210. Here are 7 key risks and challenges that could affect Belrise Industries Ltd. and its share price outlook by 2030:

-

High Dependence on the Auto Sector

Belrise earns most of its revenue from auto component sales. Any slowdown in the automobile industry—due to weak demand, policy shifts, or rising fuel prices—can hurt the company’s growth and earnings. -

Client Concentration Risk

A large portion of Belrise’s business comes from a few big customers (like Bajaj, Honda, and TVS). If any major client reduces orders or switches suppliers, it could significantly affect the company’s revenue. -

Cost Pressures & Raw Material Volatility

Fluctuating prices of key raw materials like aluminum, steel, and polymers can increase production costs. If Belrise is unable to pass these costs to customers, profit margins may shrink. -

Rising Competition in Auto Components

The Indian auto parts industry is highly competitive, with several domestic and global players. Maintaining market share and profitability will be challenging as rivals adopt advanced tech and offer better prices. -

Slowdown in EV Transition or Policy Changes

Though Belrise is EV-ready, any delay in electric vehicle adoption, or changes in EV incentives or government policies, could impact its growth in this segment. -

Execution Risks in Expansion Projects

With large-scale investments and plant expansions planned post-IPO, delays or cost overruns in executing these projects could affect operational efficiency and strain finances. -

Global Economic & Geopolitical Uncertainty

Exports and input costs may be impacted by global events like wars, trade restrictions, or currency fluctuations—posing risks to Belrise’s long-term plans and profitability.

Shareholding Pattern For Belrise Industries Share

| Held By | May 2025 |

| Promoters | 73.01% |

| Flls | 5.35% |

| Dlls | 6.8% |

| Public | 14.84% |

Belrise Industries Financials

| (INR) | 2025 | Y/Y change |

| Revenue | 82.91B | 10.78% |

| Operating expense | 8.88B | 9.36% |

| Net income | 3.55B | 14.33% |

| Net profit margin | 4.29 | 3.37% |

| Earnings per share | — | — |

| EBITDA | 10.21B | 13.81% |

| Effective tax rate | 20.23% | — |

Read Also:- GRSE Share Price Target Tomorrow From 2025 To 2030- Current Chart, Market Overview